Organization : Navi Mumbai Municipal Corporation

Service Name : Online Property Tax Payment

Website : http://www.nmmconline.com/property-tax1

Pay Here : https://www.nmmc.gov.in/navimumbai/

NMMC Property Tax Search

Go to the official website of NMMC, click on the Property option in home page,next page will be displayed, click on the property tax search option .

Related / Similar Service :

IGR Maharashtra Check SRO for Property Registration

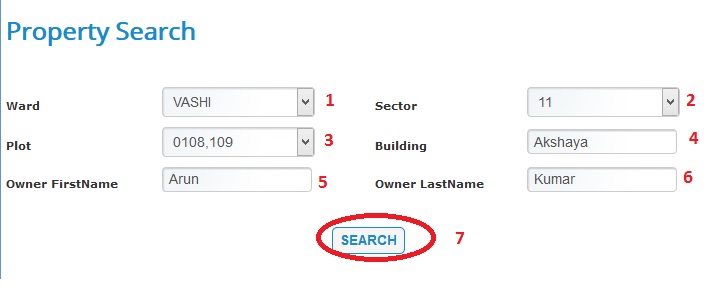

Property Search :

1. Select your Ward

2. Select your Sector

3. Select your Plot

4. Enter Your Building

5. Enter Owner First Name

6. Enter Owner Last Name

7. Click on search button.

NMMC Property Tax Payment

NMMC came into existence w.e.f. 1/1/1992. From which date provisions of the Bombay Provincial Municipal Corporations Act, 1949 became applicable to this Corporation. As per provisions of section 127 read with section 129 of the BPMC Act, 1949 all lands & building in the area of Municipal Corporation are subject to levy municipal property taxes.

Online Property Tax Payment :

1. Enter Property Code

2. Click on search button

Recovery of Property Tax

The procedure for recovery of property taxes is provided under Section 128 of the BPMC Act, 1949 which reads as under :“128. A municipal tax may be recovered by the following processes in the manner prescribed by rules :-

1. by presenting a bill

2. by serving a written notice of demand

3. by distraint and sale of a defaulter’s movable property

4. by the attachment and sale of a defaulter’s immovable property

5. in the case of octroi and toll, by the seizure and sale of goods and vehicles

6. in the case of property tax by the attachment of rent due in respect of the property

7. by a suit”.

Note:

1. After fixation of rateable value property tax bills are served on the tax payers. As per the provisions of the Act, it is necessary that the bills are paid within 15 days of its service. (Format enclosed).

2. On expire of 15 days a Notice of Demand in form -G, as required under Rule 41 of Taxation Rules, Chapter-VIII appended to the BPMC Act, 1949 is served charging therein Notice Fee @ 0.50% of the tax amount, on the tax payers. (Format enclosed).

3. If property taxes are not paid within 15 days of the service of Notice of Demand, the property is to be attached by Service of Warrant of Attachment in Form H as provided under Rule 42 of Taxation Rules, referred to above.(Format enclosed).

4. Rule 44 of Taxation Rules, provides how Warrant is to be executed in case of moveable property.

5. Rule 45 of Taxation Rules, provides how Warrant is to be executed in case of immovable property.

6. Rule 47 of Taxation Rules, provides for sale of the properties attached by public auction, if payment is not made within 5 days of service of Warrant of Attachment/Distress.

About Us:

The first post-independence development plan for Bombay, formulated by the Mayer-Modak Committee in 1948, suggested satellite towns north of Bombay. Ten years later, the Barve committee suggested the formation of a township on the mainland across the Thane Creek as a counter-magnet to draw away population from the already overcrowded city. This proposal was accepted by the BMC. Although the plan lay dormant for a long time, this was the beginning of New Bombay.

Contact Us :

Navi Mumbai Municipal Corporation

Ground Floor, Sector-15 A,

Palm Beach Junction, CBD Belapur,

Navi Mumbai,

Maharashtra-400614

Some Important Information From Comments

Error / Problem:

I want to pay property tax online for my property. But, I am not able to open the web site nmmc.gov.in. It says not private and unsafe security issue.

Information:

Most of the commenters commented that, NMMC Property tax online payment link is not working.

FAQ On NMMC Property Tax

Frequently Asked Questions FAQ On NMMC Property Tax

What is NMMC property tax?

NMMC property tax is a tax levied by the Navi Mumbai Municipal Corporation (NMMC) on properties located within its jurisdiction. It is a mandatory tax that property owners have to pay every year.

How is the NMMC property tax calculated?

The NMMC property tax is calculated based on the property’s annual rateable value (ARV). The ARV is calculated based on the property’s location, size, type of construction, age, and usage. The tax is calculated as a percentage of the ARV and can vary from year to year based on changes in the ARV.

How can I pay my NMMC property tax?

NMMC property tax can be paid online through the official NMMC website or offline at designated collection centers. To pay online, property owners have to register on the NMMC website and enter their property details. The tax amount will be calculated automatically, and the payment can be made using net banking, credit card, or debit card.

View Comments (29)

how can I see my payment history

Hello!

is there any way we can pay NMMC Property tax by UPI?

I have paid property tax paid online, how will I get the receipt

Link of Online property tax is not opening. What am I supposed to do to get the link?

I want to pay property tax online for my property. But, I am not able to open the web site nmmc.gov.in. It says not private and unsafe security issue.

Go to the following link "nmmc.gov.in/web/10156/70" for Online Property Tax Payment. Kindly note, the domain name for NMMC has changed from "nmmconline.com" to "nmmc.gov.in"

The Online Payment is not coming through as the message received continuously as "THE WEBSITE IS NOT SECURE".

I want to pay property tax online for my property. But I am not able to open the web site nmmc.gov.in.

Property tax online payment link is not working. Please suggest any other alternative links.

Go to the link nmmc.gov.in/web/10156/70 & Pay property tax online

I want to pay property tax online for my property va0000233842. But I am not able to open the web site nmmc.gov.in . It says not private.

How can I get duplicate copy of property tax bill (2017)? Please help me.

How can the property tax be calculated when our premises rented to government banks?

How can I receive Duplicate Property Tax bill for the past 2016-17(I)?

Please make your link to work.

Online property tax payment of nmmconline.com is not opening. How can I pay tax?

How can I identify your property code?

Property tax Online payment link is not working. Please suggest an alternative.

I need original tax paper.

Property tax new link is also not working.

Online Property tax payment link is not working.

Online property tax site is not working. Can someone please help me to suggest any alternative?

Online property tax is not working.

How can I make the payment? Online payment of Property Tax site is not workable. Kindly see that the system is put in order so as to streamline the site for the customers.

Property tax online link is not opening.

Property Tax payment link is not working.

How can I pay Tax?

Property tax Online payment link is not working. Please suggest an alternative.

Online property tax payment link is not opening.

Property tax Online payment link not working. Please suggest alternative.