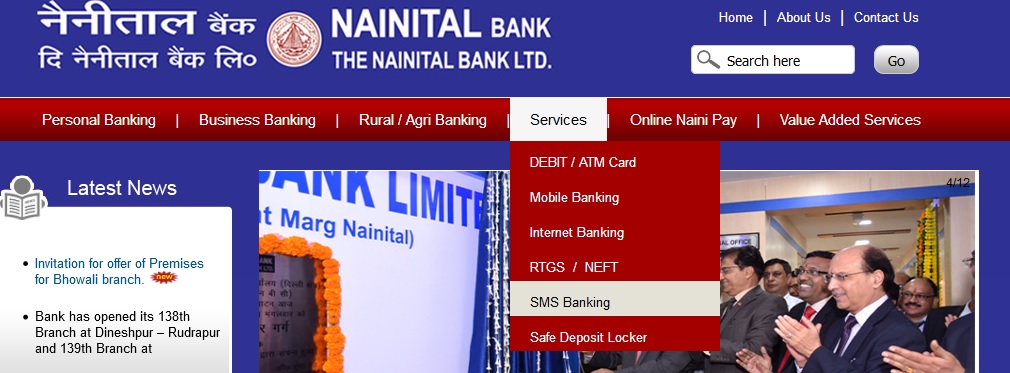

Organization : Nainital Bank

Scheme Name : Business Banking

Country: India

Business Banking : http://www.nainitalbank.co.in/english/Vyapar_Suvidha_Traders.aspx

Home Page : http://www.nainitalbank.co.in/English/Home.aspx

Business Banking

Scheme For Financing Trading Activity – Vyapar Suvidha :

Coverage & Eligibility : All individuals, firms, companies, regd. co-operative societies engaged in lawful trading of goods & commodities at least for last Two year.

Related : Nainital Bank Apna Ashiana Scheme For Granting Housing Loans : www.statusin.in/21466.html

Important-Proposals of HUF /HUF as partners and Public Limited Companies are not to be considered.

Purpose : For working capital requirement.

OR

For acquiring/purchasing assets i.e. fixtures & furniture, office equipment etc. to be used in the business.

OR

Non Fund Based Facility-LC, BG

Rate of Interest : 2.00% Over Base rate

Method of assessment of working capital : Maximum amount of limit will be lowest of the followings

20% of accepted projected sales subject to verification of sales tax returns of previous years/quarters.

OR

Advance value of collateral (after adjusting of margin).

OR

Rs.2,00,00,000/- (Rs. Two Hundred Lac only).

Personal Guarantee : No Personal guarantee is required. However if immovable property stands in the name of another person his personal guarantee to be obtained.

Prime Security :

Hypothecation of stocks.

Hypothecation of Book Debts.

Hypothecation of Assets created out of bank finance.

Collateral Security : Mortgage of immovable property (but not agricultural land), Face value of NSCs, KVPs, IVPs, and Banks own term deposit and life insurance policy (Surrender value).

Age of Property : Maximum 25 Years (building). In case the same exceeds 25 years, branch to get the property inspected by the approved architect of the bank and a certificate is obtained regarding soundness and remaining age of the construction (building) from him.

Period :

For Over Draft :

12 months, subject to annual review.

For Loan :

Maximum 84 (Eighty Four) EMI depending on the repaying capacity, subject to annual review. The DSCR should be as per LPD of the Bank.

Credit Rating : Credit rating is not linked to pricing of Loan. However Minimum credit rating should be B, while sanctioning/enhancing/reviewing the credit facility. Credit rating should be carried out on the revised enclosed format.

Take over Norms : Current ratio Min-1.17:1

DE ratio Max. 6.00:1

All other takeover norms as prescribed in Loan Policy Document are to be complied with

Naini Udhyog Prasar for MSE :

Eligibility :

The scheme is available to cover credit facilities to all eligible MSEs (Manufacturing & Services) as defined under MSMED Act, 2006. The micro and small (service) enterprises like advertising agencies, marketing/consultancy services, professional & self-employed persons like those engaged in mobile/TV repairing (not selling), small garage, juice shop, bakery owner, transport operator etc. However, following categories will not be eligible under the scheme –

** Retail Trade

** Educational Institutes

** SHGs

** Hotel /Motel and Lodges

Definition of Micro & Small Enterprises :

Enterprises* engaged in the manufacture or production, processing or preservation of goods as specified below:

Micro enterprise : Is an enterprise where investment in plant and machinery does not exceed Rs. 25/ lakh;

Small enterprise : Is an enterprise where the investment in plant and machinery is more than Rs. 25/ lakh but does not exceed Rs. 5/ crore

Enterprises* engaged in providing or rendering of services and whose investment in equipment (original cost excluding land and building and furniture, fittings and other items not directly related to the service rendered or as may be notified under the MSMED Act, 2006) are specified below.

Micro enterprise : Is an enterprise where the investment in equipment does not exceed Rs. 10 lakh;

Small enterprise : Is an enterprise where the investment in equipment is more than Rs.10 lakh but does not exceed Rs. 2 crore

*All individual/s, firms/ company /LLP etc.

Purpose :

Working Capital Limit : To meet the working capital requirement.

Term Loan / Demand Loan :

** For construction of unit’s building and purchase/installation of plant, machinery & equipments.

** Finance for commercial vehicle or other vehicle in the name of the Unit.

OR

** Takeover of existing credit facilities from other banks/FIs.

Non Fund Based Facilities : For business purpose only.

Nature of Finance :

** The facility may be either Cash Credit (working capital) limit or Term Loan/Demand Loan.

** Composite loan up to Rs 100.00 lac. (For Term Loan and Working Capital both)

** Non Fund Base facilities i.e. BG / LC

Non-Fund Based facility to those constituents who are enjoying fund based facility from other Bank/s should not be considered.

Quantum of Finance :

Maximum Rs.100.00 lacs per borrower for MSE sector (Manufacturing & Services).

Mode of Assessment :

For CC Limit :

** UPTO RS. 10.00 LAC (INCLUSIVE RS.10 LAC)

** 20% of projected & accepted sales or three (3) times of Capital & Quasi Capital. C. A. Certificate regarding Capital & Quasi Capital to be obtained.

** ABOVE RS. 10.00 LAC

** Cash Credit working capital limit is to be assessed as per turnover method, i.e., 20 % of projected and accepted annual turnover.

** The working capital limit shall be for a period of 12 months and to be renewed/ reviewed annually.

For Term Loan / Demand Loan :

Term loan can also be considered on the basis of cash flow subjected to minimum average DSCR of 1.5 for the full tenure of the loan and not less than 1.00 in any year.