Organisation : Telanagana Commercial Taxes Department (TGCT)

Facility Name : Print e-Receipt For e-Payment

Applicable State/UT : Telanagana

Website : https://www.tgct.gov.in/tgportal/index.html

How To Print TGCT e-Receipt For e-Payment?

To Print TGCT e-Receipt For e-Payment, Follow the below steps

Related / Similar Facility : TGCT eCheck Post / eTransit Pass Telanagana

Steps:

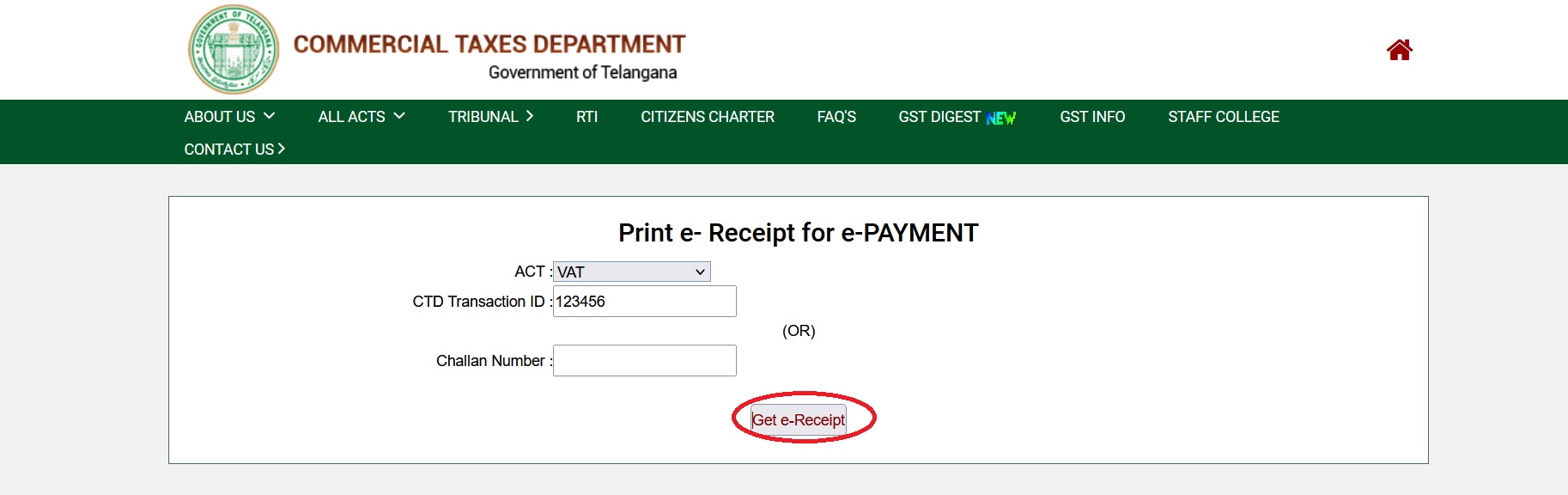

Step-1 : Go to the link https://www.tgct.gov.in/tgportal/DLRServices/Payments/eReceipt.aspx

Step-2 : Select the ACT

Step-3 : Enter the CTD Transaction ID (or) Challan Number

Step-4 : Click On “Get e-Receipt” button

FAQ On VAT

Frequently Asked Questions FAQ On VAT

What is VAT?

Value Added Tax (VAT) is a form of sales tax. It is collected in stages on transactions Involving sales of goods. Tax paid on purchases (input tax) is rebated against tax payable on sales (output tax). VAT is levied on sales of all taxable goods. VAT is not levied if sales of goods are not made in the course of or in furtherance of business.

Who should pay VAT?

An individual, partnership, company etc., who sells goods in the course of business and who is registered or is required to register for VAT should pay VAT.

When is VAT chargeable?

VAT is chargeable if the sales of goods:

** are made in the State of Telangana

** are made by a VAT dealer in the State

** are made in the course of or in furtherance of a business; and

** are not specifically exempt or zero-rated.

What other taxable sales may be liable to VAT?

Other than your normal business sales, you should also account for VAT on the Following sales:

a. Sales to your staff or sales from vending machines;

b. Sales of business assets (e.g. Equipment, furniture, commercial vehicles);

c. Sales under Hire-purchase agreement or lease of goods to someone else;

d. Works contracts

What is Input Tax?

It is VAT charged on your purchases of goods. If you are registered for VAT you can normally claim a credit for the VAT charged on most business purchases.

Contact

Email: tg_ctdhelpdesk [AT] tgct.gov.in

Phone number: 18004253787