EPFO Know Your Claim Status : Employees Provident Fund Organization

Organization : Employees Provident Fund Organization

Facility : Know Your Claim Status

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Home Page : http://www.epfindia.com/ClaimStatus_New.html

How To Know EPFO Claim Status?

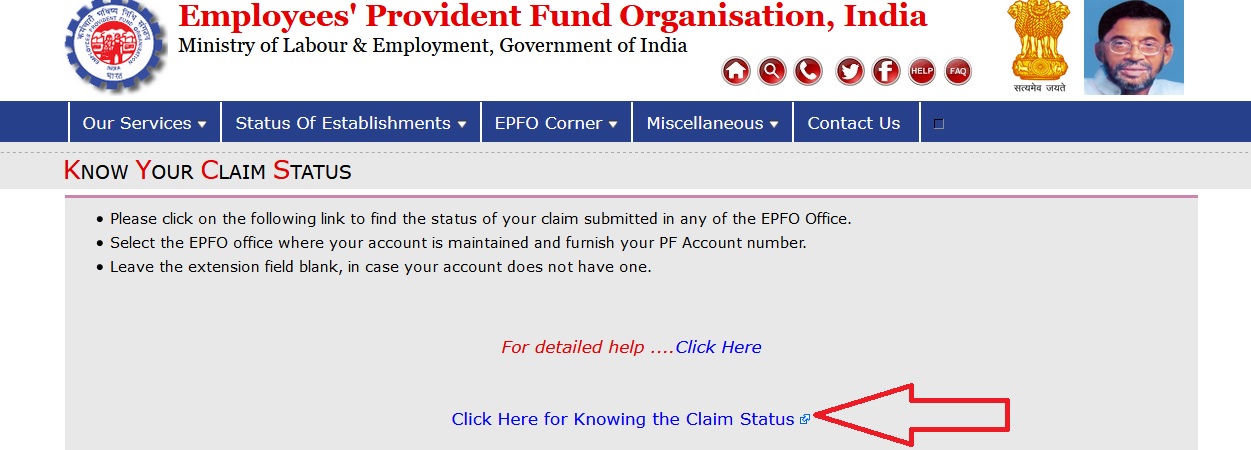

** Please click on the following link to find the status of your claim submitted in any of the EPFO Office.

Related : EPFO Know Your EPF Balance : www.statusin.in/2669.html

** Select the EPFO office where your account is maintained and furnish your PF Account number.

** Leave the extension field blank, in case your account does not have one.

How To Use Facility?

This facility is meant for EPF Members/subscribers/pensioners who have submitted a claim in any of the EPFO offices across India. Using this facility one can track the status of a claim so submitted. The only pre-requisite is you must know your PF Account Number.

** If you know the EPF Office from where your claim has to be settled, select the same from the office drop down list.

** On selection of office, the mandatory Region Code and Office Code will get populated automatically in the respective boxes.

** Enter the Establishment Code in the third box – which can be of maximum 7 digits.

** In case the Establishment Code has an extension / sub-code, enter the same here. It can be a digit or letter as the case may be and can be of maximum 3 characters in size. Leave this field blank, if there is no extension /sub-code to the Establishment Code.

** Enter your account number which can be of maximum 7 digits.

How To Get Status?

Click on submit to get the status :

Example I :–

Case – I – PF Account Number without an extension/sub-code to Establishment Code:

** Suppose your PF Account Number is MH/35634/523 and the office is Bandra, Select Bandra from the list as under :

** Note that MH and BAN has been populated already in the first two fields.

** Now enter the Establishment Number :

** Leave the next field – Extension – blank and enter your account number in the last field :

** Now click on “Submit” to get the status.

** As this is an non-existing number, we get a “No Record Found” message. In legitimate cases, appropriate messages will be displayed.

Example II :-

Case – II – PF Account Number without an extension/sub-code to Establishment Code:

** In case there is an Extension/Sub-Code to the Establishment Code, say, “A”, then enter the same as under before entering the account number :

** Now Click on “Submit” to get the status :

** Again, as this is an non-existing number, we get a “No Record Found” message. In legitimate cases, appropriate messages will be displayed.

Noe :-

Please note that in case the claim is not entered in the system/software for some reason or it is outside the dates as mentioned in the footer of the screen above, such a record will NOT appear in this facility. In other words, ideally, a claim should have been submitted and an system generated claim ID should have been obtained for using this facility.

FAQ On EPFO

Sure, here are some FAQ on EPFO:

What is EPFO?

EPFO stands for Employees’ Provident Fund Organisation. It is a statutory body established under the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952. EPFO is responsible for administering the Employees’ Provident Fund Scheme, the Employees’ Pension Scheme, and the Employees’ Deposit Linked Insurance Scheme.

Who is eligible to join EPFO?

Any employee who is employed in a establishment covered under the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952 is eligible to join EPFO. The establishment must have at least 20 employees.

What are the benefits of joining EPFO?

The benefits of joining EPFO include:

** Provident Fund: The employee and the employer contribute 8.33% of the employee’s basic wages and dearness allowance to the Provident Fund. The employee can withdraw the money from the Provident Fund after 5 years of service.

** Pension: The employee and the employer contribute 8.33% of the employee’s basic wages and dearness allowance to the Pension Fund. The employee can get a pension after 60 years of age.

** Insurance: The employee and the employer contribute 0.5% of the employee’s basic wages and dearness allowance to the Insurance Fund. The employee’s family will get a lump sum amount if the employee dies while in service.

What are the documents required for withdrawal?

This is useless site to know claim position. Payment is pending since December 2017. My claim number is 16080211.

Can I know my number if I lost without the aid of the institution, where I worked?

What will be the documents produced in withdrawal?