SBI International Banking : State Bank of India

Organization : State Bank of India

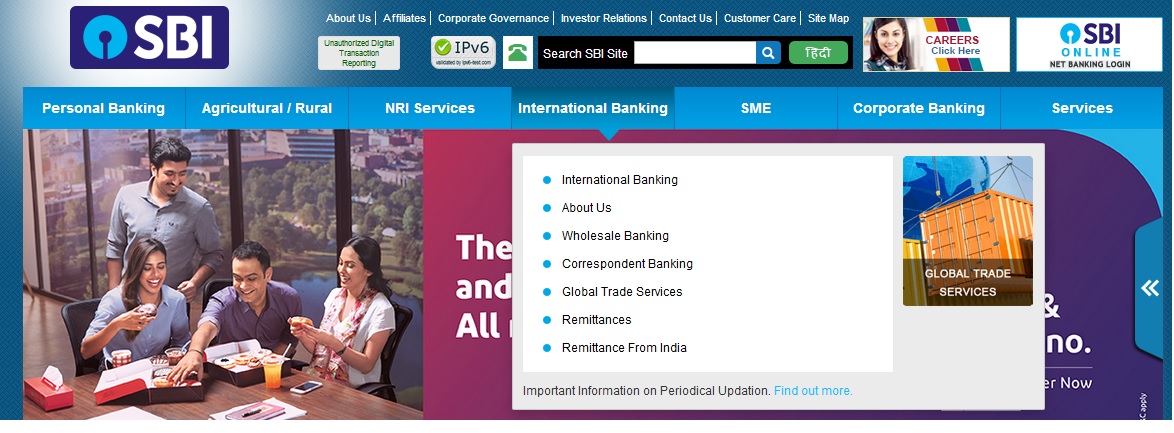

Service Name : International Banking

Website : https://www.sbi.co.in/portal/web/international/international

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

SBI International Banking

** 198 offices in 37 countries; 301 Correspondent Banks across 72 countries

** An ideal business partner for individuals and institutions across the globe

Related : SBI Fleet Finance Scheme : www.statusin.in/19948.html

** State Bank of India’s dedicated and skilled team of professionals enables you to meet your business and personal needs by providing comprehensive international banking products, services and financial solutions, tailor-made to meet your overseas banking requirements.

Retail Banking

** State Bank of India is the largest and oldest Retail Banking player in India.

** With the most extensive network of branches and ATM, we proudly call ourselves ‘The Banker to every Indian’.

** At present, we have retail operations in twenty two countries abroad, the largest global presence of any Indian bank offering a wide range of deposit and loan products as well as value added banking services.

** Send money internationally through SBI Express / Instant Transfer, protect your savings through our secure and competitive deposit accounts, and fulfil your dreams and your aspirations through our value added loan products!!!

Wholesale Banking

** We provide comprehensive solutions to your business needs, combining financial expertise with a complete suite of products to ensure that our corporate and institutional customers achieve their goals.

** Our products, including project export finance, capital market funding, overseas credit and corporate banking are customized to serve your local needs on a global scale.

Merchant Banking

** As your strategic partner, we provide a broad and complimentary range of services to address your business needs.

** Our expertise, insight and competitive rates in Foreign Currency loans give an edge to your business.

** We invite you to use our comprehensive array of strategic and financial advisory services including mergers and acquisitions, Bilateral Foreign Currency Loans, Syndicated Loans and Reverse FDIs.

Correspondent Banking

State Bank of India, with one of the largest strategic banking relationships worldwide, provides you and your customers the benefit of our international reach and wide range of global correspondent banking services.

As your correspondent banking partner we offer you the full range of our business expertise, service offerings and experience of over 90 years, with valued relationships with over 1578 leading banks across 129 countries.

** Payment Solutions

** Treasury Management

** Foreign Exchange

** Nostro/Vostro Accounts

** Relationship Management

REMITTANCE FROM INDIA :

Now remittances from India are much easier and faster through our new product fxout and remxout.

FXOUT:

** Available at all branches of SBI.

** Available to resident individuals and customers of SBI.

** Highly competitive and transparent rates.

** Remittances can be for all the purposes prescribed underLiberalisedRemittance Scheme (LRS) of RBI.

** Available uptoINR equivalent of 10.00 lacsper transaction subject to a maximum equivalent of USD 250000 per annum.

** Available in USD, GBP, EUR, AUD, SGD and CAD.

** Customers to visit the home branch with the details of beneficiary. (The account to be KYC compliant and PAN updated)

REMXOUT :

** Available to all Retail Internet Banking users through onlinesbi.com. (onlinesbi.com)

** Highly Competitive and transparent rates.

** Remittances under LiberalisedRemittance Scheme (LRS) of RBI can be initiated on internet.

** Available upto equivalent of USD 2000 per transaction subject to a maximum of USD 250000 or its equivalent per annum.

** Available in USD, GBP and EUR.

Others :

** For all other remittances not covered under ‘fxout’ and ‘remxout’, customers can approach forex authorized branches of SBI.

** For more information please contact fxout.gmuk[AT]sbi.co.in through mail.

Treasury Management

Our team of expert dealers and fund managers offers an array of treasury and hedging products to provide an edge to your business operations. Asset liability management products, investments, forex, derivatives and trading options in various asset classes besides raising of medium and long term resources are offered by us.

** Asset Liability Management

** Forex and Money Market

** Investments

** Fund Raising

** Bond Issuance

Asset Liability Management (ALM):

The ALM function comprises management of liquidity, maturity profiles of assets and liabilities and interest rate risks at the Foreign Offices. Activities include monitoring of structural mismatches in liquidity at Foreign offices, capital charge for Market Risk for IBG, conducting stress test on liquidity risk, interest rate risk and forex risk at periodic intervals, formulation and periodical review of ALM Policy for Foreign Offices and allocation of capital to Foreign Offices.

I want to know, how I can send money (from India) internationally (to USA) through SBI Express / Instant Transfer?

I am a resident of India and maintaining savings account with SBI. Can I send money to my son in USA. What is maximum limit and procedure?