chennaicorporation.gov.in Check Property Tax Payment Status : Corporation of Chennai

Organization : Corporation of Chennai

Facility :Check Property Tax Payment Status

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Home Page : http://www.chennaicorporation.gov.in/online-civic-services/Payment_NewIndex.htm

How To Check Chennai Corporation Tax Payment Status?

kindly follow the below steps to Check Property Tax Payment Status for Corporation of Chennai.

Related : Corporation of Chennai Calculate Profession Tax Online Tamil Nadu : www.statusin.in/5908.html

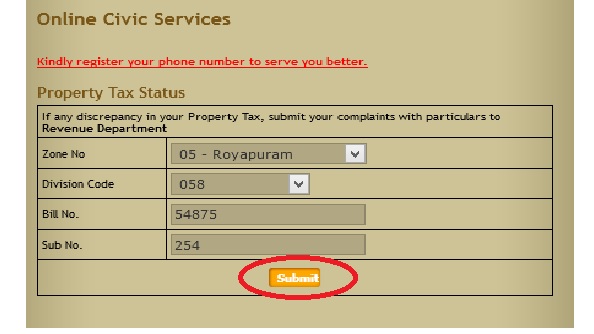

Check Property Tax Payment Status

** Select the Zone with Number.

** Select the Division Code.

** Enter the Bill Number.

** Enter the Sub Number.

** Click on Submit Button.

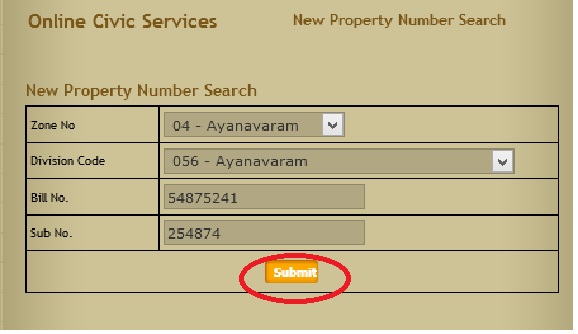

Search New Property Number

** Select the Zone with Number.

** Select the Division Code.

** Enter the Bill Number.

** Enter the Sub Number.

** Click on Submit Button.

Procedure to be followed for assessment of property tax :

** The application submitted by the applicant will be scrutinized by the Assessor.

** After informing the applicant the Assessor will measure the newly constructed building and submit the proposal to the concerned officer.

** After the field verification of the approval officer(if required) the proposal will be submitted to the Assessment Committee

** The committee will select the proposals randomly to verify the correctness of the assessments.

** After scrutiny, the committee will approve the proposals.

** After approval of the committee the new assessment order (Notice 6) will be issued to the assessee. The assessees are also informed through SMS.

Payment of Chennai Corporation Property Tax

The assesee should make property tax payment by Cheque or Demand Draft drawn in favour of “The Revenue Officer, Corporation of Chennai” at anyone of the following modes :

** Through the Tax Collectors,

** Through banks under walk in payment system (IOB, CUB, KVB, HDFC, IDBI, Canara Bank, TMB, Kotak Mahindra Bank, Lakshmi Vilas Bank, Yes bank and IndusInd Bank (even by cash),

** At all e-seva centres (Common Service Centres) set up by State Government through Tamil Nadu Arasu Cable Television Corporation established in all Taluk Offices of Chennai District, Zonal Offices, Divisional Offices, & Head quarters of Greater Chennai Corporation,

** On-line at Official Website with “Nil” transaction fee by using Credit Card, Debit Card and through Net Banking

About Us:

The Corporation of Chennai (previously Madras) is the Oldest Municipal Institution in India established on the 29th September 1688. A charter was issued on the 30th December, 1607 by East Indian Company constituting the “Town of Fort St. George” and all the territories thereunto belonging, not exceeding the distance of ten miles from the Fort, into a Corporation.

The Parliamentary Act of 1792 gave the Corporation power to levy Municipal Taxes in the City. The Municipal administration properly commenced from the Parliamentary Act, 1792 making provision for the good order and administration of the city. The Municipal Act has been amended introducing from time to time major changes in the constitution and powers of the Corporation.

Contact Us :

Dr. D. Karthikeyan I.A.S

Greater Chennai Corporation,

Ripon Building,

Chennai-600003.

FAQ On Chennai Corporation Profession Tax

Here are some frequently asked questions (FAQ) about Chennai Corporation Profession Tax:

Who is liable to pay Profession Tax in Chennai?

Every person who is engaged actively or otherwise in any Profession, Trade, Calling and Employment within the Greater Chennai Corporation city limits is liable to pay Profession Tax.

What is the rate of Profession Tax in Chennai?

The rate of Profession Tax in Chennai is as follows:

** For individuals: Rs. 25 per half-year

** For companies: Rs. 100 per half-year for the first Rs. 20,000 of gross income, plus Rs. 25 per half-year for every Rs. 5,000 of gross income in excess of Rs. 20,000, subject to a maximum of Rs. 1,000 per half-year.

When is Profession Tax due in Chennai?

Profession Tax in Chennai is due on the 10th of every half-year. If the tax is not paid by the due date, a late fee will be charged.

Please see the bill payment receipt of Bill no 15-193-00816-000 from Thoraipakkam.

Old bill number : okt -3434

Please provide correct tax bill number for 12 / 157/07 401 /000 ebony flats plot no 110/1a/2a RIVER VIEW LINK road Manapakkam Chennai 600125 either in the name of Shri v rajendra babu or mrs soumya lakshinarayanan to enable me pay up to date taxes Soumya.

Receipt no: 2013-14/N15/1203238

My old zone no.01, div.no.6 bill no.4084 .

We need details of current position

MY old assessment no is 14542. no 15/16 gopalakrishnan street

Kindly provide the new assessment no for property tax

Please provide the details for payment.