etdut.gov.in E-Form Chandigarh : Excise & Taxation

Organisation : Excise & Taxation Department

Service Name : E-Form

Applicable States/ UTs : Chandigarh

Website : http://etdut.gov.in/ExciseOnline/index.html

Details : https://www.statusin.in/uploads/38104-EForms.pdf

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

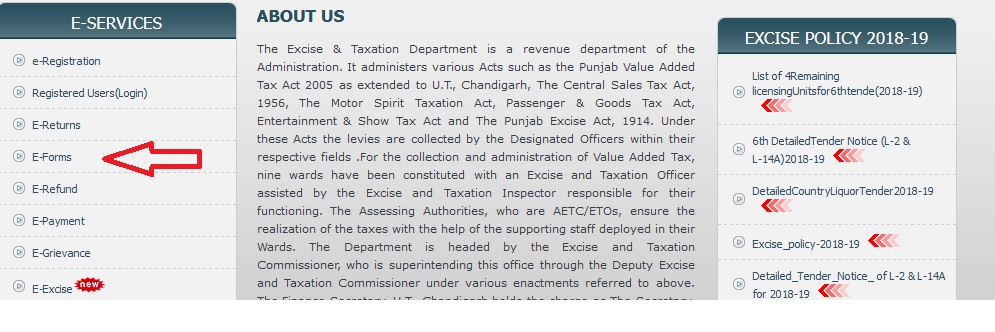

ETDUT E-Form

E-Forms module is designed to enable the dealers to request the forms online. They need not go to the Excise and Taxation Department to request the forms physically.

Related : Excise & Taxation E-Return Chandigarh : www.statusin.in/38099.html

An acknowledgement receipt number is generated on successfully uploading the request on server. Dealer can also check the status of requested forms against receipt number. Dealer will download and print e-forms through ETD-website

Getting Started

1. First of all, dealer will visit the ETD- website

2. Type the URL in the address bar of the selected browser

3. Once the web site is connected the Home page will appear

Login

1. On the left hand corner of the home page (Screen–1) there is a Registered Users (Login) link. Please click on it.

2. A new screen will open as shown below (Screen–2). Please enter following details in the screen.

Login id –Your 11 digit TIN

Password – Your 11 digit TIN until you did not change.

Download Excel Format

To request the forms, you are required to download the excel format of statutory form request. It is advisable to download these forms once and store for future use. You should have Microsoft Office Excel (version may be 2003, 2007 or 2010) installed in your computer for this purpose.

Note : You have to enter all the required information in excel. Don’t change in any column name of Excel otherwise you can’t upload the request on server.

Verify & Upload the Request

1. When you filled excel file, you have to upload it with respect to selected form-type.

2. When you click on Form Request Details link, you get the total amount party-wise details wrt financial year, quarter and month.

3. When you click on upload link, you get the confirmation message “You are uploading the data on server. After that, you can not add/update the record of selected form. Are you sure want to upload the data on server?”

4. When you click on OK button, your form request will upload successfully and get the receipt number

Check the Status of Form Request

** When you click on Check Status link, you get the following page

** When your request approved by Taxation Inspector of your ward then the status of your request

** Finally, your form request will be approve by Excise Taxation Officer (ETO) of your ward.

** When your request approved by Excise Taxation Officer of your ward then the status of your request

** When you click on See Details link, you get the status of all party-wise wrt year, quarter and month

View the Requested Forms

** When you click on View link, you get the confirmation message “You will get the password on your registered mobile to download the requested forms. If you did not register/update your mobile number, Please register/update it from (Dashboard->User Profile->Update Personal Information). Are you sure want to get the password?”

** When you click on OK button, you will get the message on your registered mobile and list of approved forms wrt receipt number

Important Points

** The e-form request will be only verified and uploaded if the dealer has entered the mandatory fields irrespective of optional forms.

** For Form C, Form H, Form F, Form E1 and Form E2 .xls format will only be accepted.

** It is required to upload the same form that is downloaded from the website. Copy of any other form file will not be accepted.

** You will get the password on your registered mobile to download the requested forms. If you did not register/update your mobile number, Please register/update it from website. This PDF password will be same all the time wrt receipt number.

** Please do not share the password with anybody.