TIN NSDL OLTAS System Challan Status Inquiry : Income Tax

Organisation : Income Tax Department

Facility Name : OLTAS Challan Status Inquiry

Website : https://www.protean-tinpan.com/about-us.html

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

TIN NSDL OLTAS System

Income Tax Department’s initiative to receive information and maintain records of tax paid through banks through online upload of challan details is named as OLTAS (Online Tax Accounting System).

Related / Similar Facility : TIN NSDL AIN Online Registration

Challan Status Inquiry

TIN provides a facility to the tax payers to enquire about the status of their challans over the internet. Using this facility they can satisfy that your tax payment has been properly accounted for in your name. The collecting banks can also use this facility to enquire about the status of the challans uploaded by them.

Check Status Here : https://tin.tin.nsdl.com/oltas/index.html

Challan Status Enquiry For Tax Payers

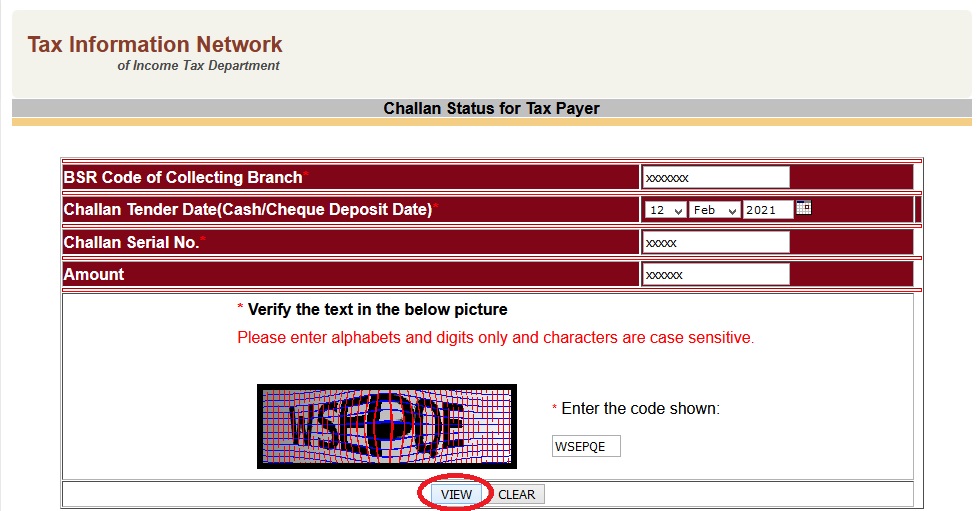

Using this feature, tax payers can track online the status of their challans deposited in banks.This offers two kind of search.

a) CIN based view :

On entering Challan Identification Number (CIN i.e. details such as BSR Code of Collecting Branch, Challan Tender Date & Challan Serial No.) and amount (optional),the tax payer can view the following details:

** BSR Code

** Date of Deposit

** Challan Serial Number

** Major Head Code with description

** TAN/PAN

** Name of Tax Payer

** Received by TIN on (i.e. date of receipt by TIN)

** Confirmation that the amount entered is correct (if amount is entered)

b) TAN based view :

By providing TAN and Challan Tender Date range for a particular financial year , the tax payer can view the following details :

** CIN

** Major Head Code with descriprtion

** Minor Head Code

** Nature of Payment

If the tax payer enters the amount against a CIN, the system will confirm whether it matches with the details of amount uploaded by the bank.

Challan Status Enquiry For Banks

Using this features, tax collecting branches and the nodal branches can track online the status of their challans deposited in banks as follows :

a) Collecting Bank Branch :

On providing the branch scroll date and the major head code – description, the tax collecting branch can access the total amount and total number of challans for each major head code. Further, the collecting branch can view following details:

** Challan Serial Number

** Challan Tender Date

** PAN/TAN

** Name of Taxpayer

** Amount

** Date of receipt by TIN

b) Nodal Bank Branch :

On providing the nodal scroll date and the major head code-description, the nodal branch can view the following details:

** Nodal Branch Scroll Number

** Scroll Date

** Major Head Code – Description

** Total Amount

** Number of Branches

** Number of Challans

Further, for each Nodal Branch Scroll Number, following information can be accessed:

** BSR Code

** Branch Scroll Number

** Branch Scroll Date

** Total Amount

** Number of Challans

** Date of receipt by TIN

Contact

Tel : 1800-180-1961

Email : ask@incometaxindia.gov.in

BSR Code – 0264085 which bank bsr code