Commercial Taxes Department GST Puducherry : Online Issue of Form-C

Organization : Commercial Taxes Department Puducherry

Facility :Online Issue of Form ‘C’

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

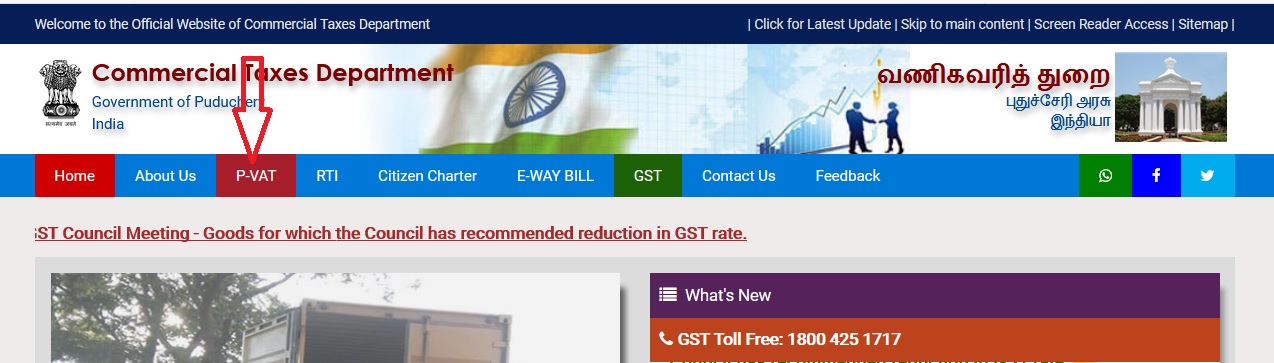

Home Page : https://gst.py.gov.in/

GST Puducherry Online Issue of Form C

Visit the GST Puducherry Commercial Taxes Department’s official web-site. Click ‘Online Services’ link button and login to your account

Related : GST Puducherry e-Registration of VAT/ CST & View Status : www.statusin.in/4561.html

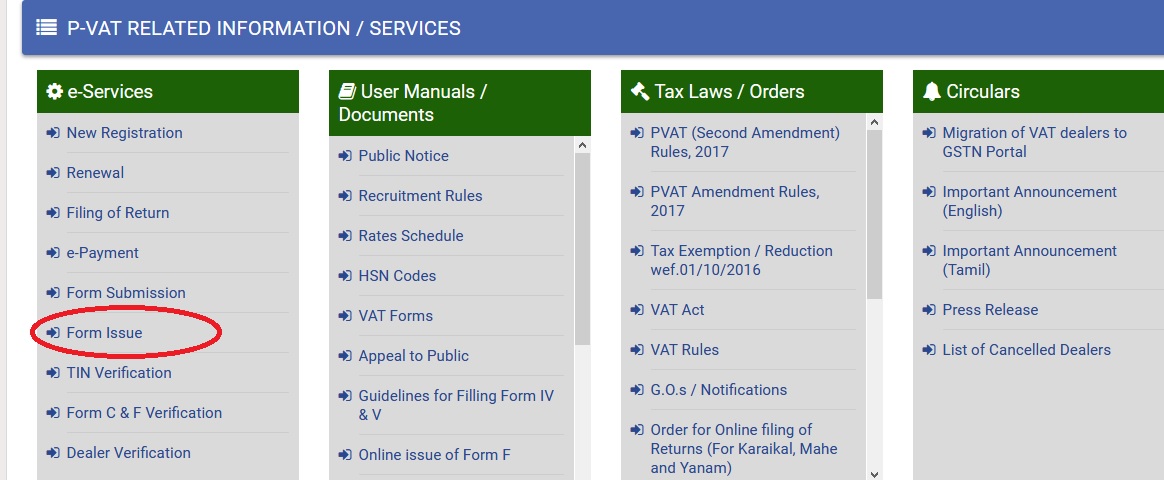

Click Form Issue link under e-Services tab. You will be redirecting to the website of the Commercial Taxes Department, UT of Puducherry.

** In the main page various options are displayed. Here, select the ‘Requisition’ option in Online Issue of Forms menu. System will allow to proceed further, only if the dealer is registered under the CST Act, 1956.

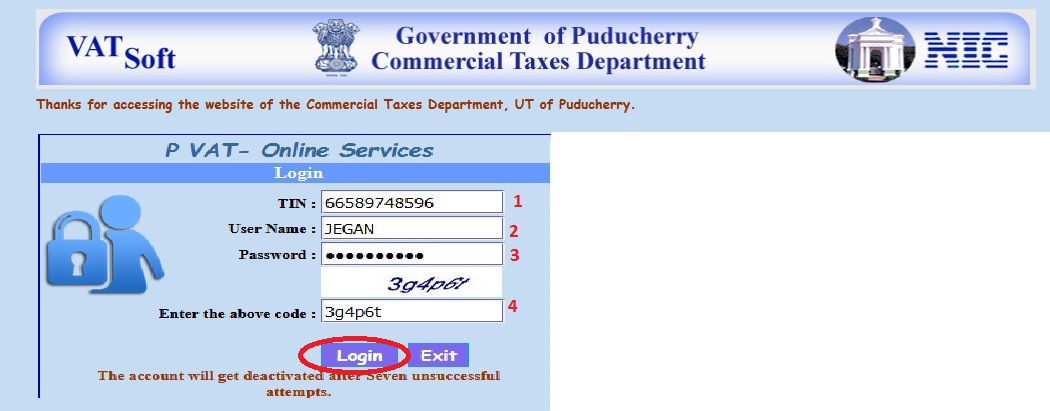

Login using all the credentials required.

Step 1 : Enter TIN Number

Step 2 : Enter User Name

Step 3 : Enter Password

Step 4 : Enter the Code

Step 5 : Click Login Button.

** Select the appropriate ‘Month’ & ‘Year’ and press ‘GO’ button. In the following screen enter the seller’s details. In this page, the dealer has the facility to view the commodities covered under their certificate of registration issued under the CST Act 1956 and details of arrears by selecting the appropriate links.

** Now Add the transaction details one-by-one for the chosen month. Here, system verifies whether invoice date falls in the same month. Also system does not allow for the duplicate invoice entry. After entering all the required details and information dealer can click the SUBMIT button.

** Alternatively one can save the details by clicking the SAVE & EXIT button without submitting. Later, one can click the ‘Update & Submit’ option, available in the Main Menu of the online issue of Forms. Now the list of the saved invoices details is shown.

** After successfully uploading the XML file, the dealer has to click the ‘Update and submit’ button in the Main menu, the following page will appear.

** After the submission of the requisition for “C” form through online the department takes 7 days for approval after checking all the parameters. Thedealer can see the status of his request by clicking the view status option. If the Status is shown as approved, then the dealer can take the printout of the C-Form by selecting ‘Print Forms’ in the main menu of the online issue of forms. The ‘C’ form and its annexure will appear.

Service Details

This service is provided to the dealers without collecting any user charges. This service will be extended shortly for other Forms i.e. Form – ‘F’, Form – ‘H’ etc. based on the feed back received from the dealers.

Introduction of this Online Issue of ‘C’ Form will considerably save the time of the Business community. The system of issue of ‘C’ form is fully computerized and there will be no manual interruption. Thereby, it brings transparency in the Administration.

This manual describes the procedure for obtaining ‘C’ form through online in a step by step method. For further clarification and doubts if any, one can contact the Assessing Officer concerned.

FAQ On GST Puducherry

Frequently Asked Questions FAQ On GST Puducherry

Q: What is GST Puducherry?

A: GST Puducherry is the Goods and Services Tax (GST) implemented in the Union Territory of Puducherry, India. It is a value-added tax that is levied on the supply of goods and services in Puducherry.

Q: What are the benefits of GST Puducherry?

A: GST Puducherry has several benefits, such as the simplification of the indirect tax structure, reduction in the tax burden on businesses, and the elimination of multiple taxes. It also promotes ease of doing business and increases transparency in the tax system.

Q: What is the GST rate in Puducherry?

A: The GST rate in Puducherry is the same as the GST rate applicable in other parts of India. It is levied at different rates ranging from 0% to 28% based on the type of goods or services supplied.

Q: Who needs to register for GST in Puducherry?

A: Any business or individual involved in the supply of goods or services in Puducherry with an annual turnover of more than Rs. 20 lakhs (Rs. 10 lakhs for special category states) is required to register for GST.