tnurbanepay.tn.gov.in : Apply For Profession Tax Online Tamil Nadu

Organisation : Commissionerate of Municipal Administration

Facility Name : Apply For Profession Tax Online

Applicable For : Residents of India

Applicable State/UT : Tamil Nadu

Website : https://tnurbanepay.tn.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Apply For Profession Tax In Tamil Nadu?

Follow the below steps to apply for Profession Tax in Tamil Nadu [TNURBANEPAY]

Procedure for application (New applicant):

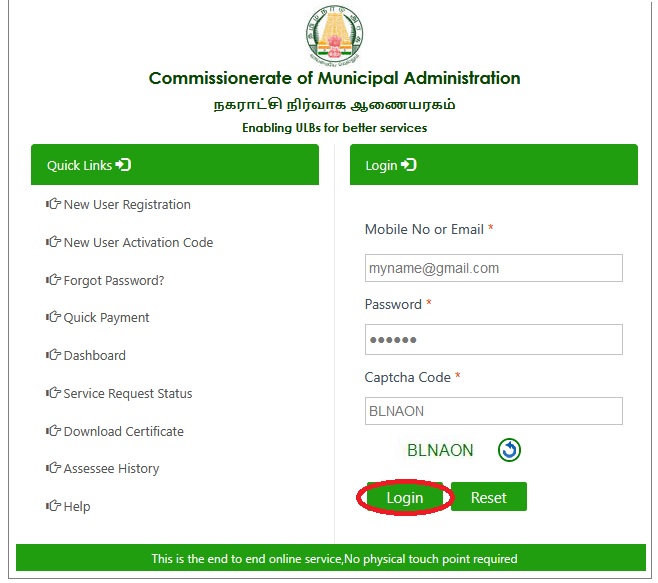

1. The applicant logs in and navigates to the concerned tab for profession tax application in the Citizen Portal (https://tnurbanepay.tn.gov.in/LoginPage.aspx?ReturnUrl=%2fLandingPage.aspx)

2. The applicant has to choose the category in which he is applying-Is the applicant an Individual or Organization.

3.The procedure is common for an individual and organization (only the applicant screen with details/ documents required will modify accordingly):

a. Applicant fills the online application form and requisite documents are uploaded.

b. Once application is submitted, the application goes to Revenue Assistant

c. Revenue assistant scrutinizes the application and forwards the file to Revenue Inspector

d. Revenue Inspector(RI) scrutinizes the application file and the documents and goes for inspection(in some cases Revenue Assistant may also accompany the RI). Post inspection,the file is forwarded to the Revenue Officer along with the inspection note/ report.

e. The Revenue Officer(RO), scrutinizes the inspection note/ report from RA and RI and also the application file, and may go for another inspection if required. Revenue Officer [RO]then adds any additional remarks and forwards the file to the Commissioner for final approval.

f. Commissioner scrutinizes the application and provides approval. (Note: Commissionermay also inspect and if needed reject the application if he deems necessary). Note: If an application is rejected, the reason for rejection is to be mandatorily inserted by the Commissioner.

g. Once the approval is given by the Commissioner, the“Demand notice”is automatically raised by the system and an intimation is sent to the applicant in the form of assessment order.

h. Applicant can pay their due/demand amount online.

i. Post payment by the applicant, receipt/ certificate is generated by the system and will be sent to the applicant through email and also available for download in the citizen portal.

Return Filing Procedure (Existing Applicant):

1. The applicant logs in and navigates to the concerned tab for profession tax renewal in the Citizen Portal (https://tnurbanepay.tn.gov.in/LoginPage.aspx?ReturnUrl=%2fLandingPage.aspx)

2. Applicant enters the assessment number in the search fields provided in the online portal

3. Relevant basic details(such as Proprietor name, TIN/ PAN etc.)are automatically loaded and assesse can enter the additional details/ upload required documents

4. Once the details are submitted, the payment screen will be presented to the applicant

5. Applicant makes the payment online and the receipt/ certificate is generated by the system

6. The receipt/ certificate will be sent to the applicant by email and would also be available in the citizen portal.

Checklist of Tamil Nadu Profession Tax Application

Checklist of documents/ details required(New applicant):

In case of Individual:

1. Last six months’ salary details, last six months income proof (Payslip) only

2. PAN

In case of Organization:

1. PAN/GSTIN

2. Statement of Gross half yearly income of the Employees (including individual employee wise employee code, employee name details & tax amount deducted per employee) (in case of organizations-State,Central,and Private)

Note:

All the above mentioned details are to be provided by the applicant in PDF file format.If a company has started operations and has not paid the profession tax fora long time then details of the arrears are to also be provided by the applicant

Checklist of documents/ details required(existing applicant):

Individual:

1.Last six months’ salary details, last six months income proof (Payslip) only.

Organization:

1.Statement of Gross half yearly income of the Employees (including individual employee wise employee code, employee name details & tax amount deducted per employee) (in case of organizations-State,Central and Private) and tax paid receipt

Note:

All the above mentioned details are to be provided by the applicant in PDF file format