CDMA Telangana Assessment of Vacant Land Tax

Organisation : Commissioner & Director of Municipal Administration, Government of Telangana

Facility Name : Assessment of Vacant Land Tax

Applicable State/UT : Telangana

Website : https://emunicipal.telangana.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Apply For CDMA Vacant Land Tax Assessment?

To apply for CDMA Vacant Land Tax Assessment, Follow the below steps

Related / Similar Facility : CDMA Mobile Tower Application Telangana

Steps:

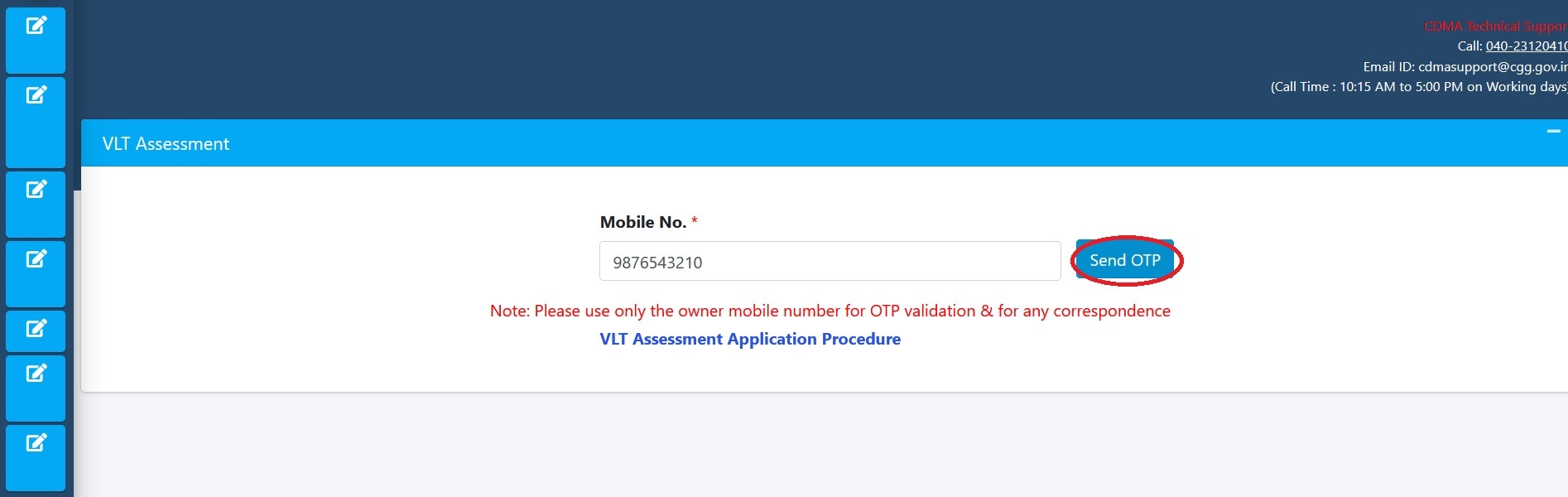

Step 1: Applicant goes through the Mobile OTP Validation to access the Assessment Application Form

Step 2: Applicant needs to fill the required details & uploads and submit the application.

Step 3: On Submit, an Application ID is generated and an SMS is sent to the applicant for further reference. On submit the application is forwarded to the Revenue Inspector (RI) login for Inspection

Step 4: The Revenue Inspector (RI) does the inspection and submits the field report. The application is forwarded to the Revenue Officer (RO) for verification & approval

Step 5: The Revenue Officer (RO) does the verification & approves. The application is forwarded to the Municipal Commissioner (MC) for approval

Step 6: The Municipal Commissioner (MC) verifies and approves. Upon approval by the MC, the payment link will be SMSed to the applicant/citizen for payment

Step 7: On successful payment a 10-digit assessment number is generated with Assessment Certificate and an SMS is sent to the applicant

Documents Required For CDMA Vacant Land Tax Assessment

Registered Document/Court Decree/Patta (or) Registered Document Copy, Approved Layout Sanction Copy, Vacant Land Photo (Zoom In), Vacant Land Photo (Zoom Out),

Timeline For CDMA Vacant Land Tax Assessment

CDMA Vacant Land Tax Assessment Timeline 15 Days

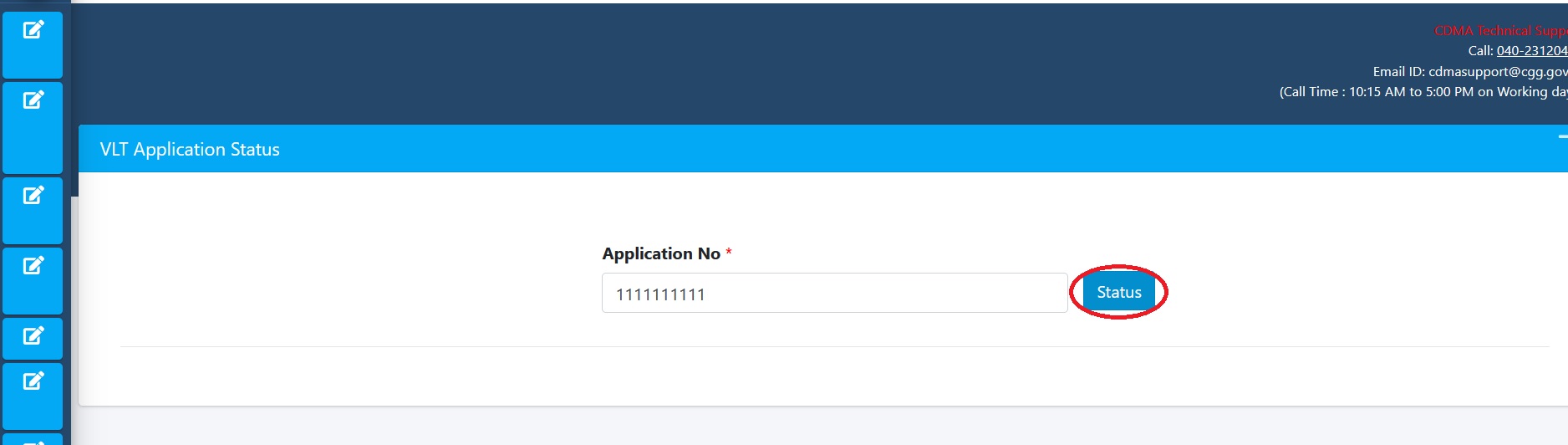

How To Check CDMA Vacant Land Tax Application Status?

To Check CDMA Vacant Land Tax Application Status, Follow the below steps

Step-1 : Go to the link https://emunicipal.telangana.gov.in/

Step-2 : Enter the Application Number

Step-3 : Click on Status button

What is Vacant Land Tax?

The vacant lands within the limits of the ULB are also taxed based on certain criteria. The vacant lands are identified and assessed for fixation of a Vacant Land tax, which is levied on the owner of the particular vacant land by the Revenue section of the ULB. The main functions/processes of the Revenue section with reference to Vacant Land tax are as follows.

** Receipt of application for assessment, inspection, processing of the application.

** Issue of notices to owner of Vacant lands.

** Assessment of the Vacant Land tax.

** Issue of demand notices.

** Collection of taxes and maintenance of the records.

** Receipt of application for title transfer, inspection, processing and recording of title transfer and collection of title transfer fee.

CDMA Contact

Technical Support: cdmasupport AT cgg.gov.in | +914023120410 (10:00 AM to 5:00 PM on Working days)