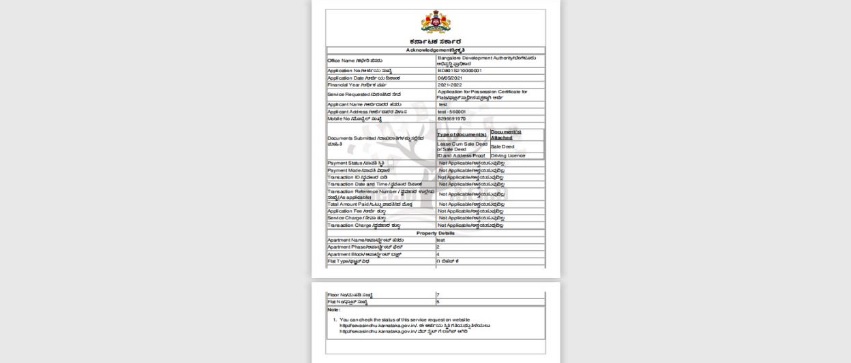

BDA e-Khata Transfer Bangalore : sevasindhu.karnataka.gov.in

Organisation : Bangalore Development Authority (BDA)

Facility Name : Application For e-Khata Transfer

Applicable For : Property should be located in BDA limits

Applicable State/UT : Bangalore Karnataka

Website : https://sevasindhu.karnataka.gov.in/Sevasindhu/DepartmentServices

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Apply For BDA e-Khata Transfer?

To Apply For BDA e-Khata Transfer, Visit Sevasindhu Karnataka and Follow the below steps

Related / Similar Facility : BDA New e-Khata Application Bangalore

Steps:

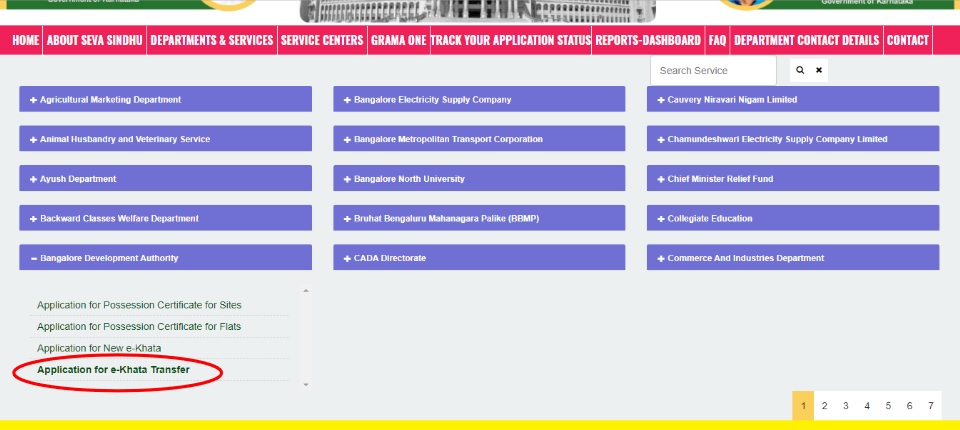

Step 1: Go to sevasindhu.karnataka.gov.in website and click on Departments & Services

Step 2: Click on Bangalore Development Authority and select Application for e-Khata Transfer. Alternatively, you can search for Application for e-Khata Transfer in the search option.

Step 3: Click on Apply online

Step 3: Click on Apply online

Step 4: Enter the username, password/OTP, captcha and click on Log In button

Step 5: Fill the Applicant Details

Step 6: Verify the details. If details are correct, select the checkbox (“Yes”) & Submit

Step 7: A fully filled form will be generated for verification, if you have any corrections click on Edit option, Otherwise proceed to attach annexure

Step 8: Click on Attach annexure

Step 9: Attach the annexure and click on save annexure.

Step 10: Saved annexures will be displayed and click on e sign and Submit to proceed.

Step 11: Click on I agree with above user consent and eSign terms and conditions and Select authentication type to continue and Click on OTP

Step 12: Enter Aadhar Number and click on get OTP

Instructions:

a. Application submission by allottee (Online, B1/K1 centres, CSC centres, AJSK centres, Bapuji Seva Kendras)

b. The application is routed to Revenue Officer

c. Revenue Officer forwards the application to concerned Revenue Inspector

d. Revenue Inspector verifies and forwards the application to the Manager for recommendations

e. Manager verifies submitted documents and application form and provides recommendations to Revenue Officer

f. Revenue officer approves or rejects the Khata transfer, enters the fee amount and signs the certificate based on the documents verification

g. Applicant makes the payment for the approved Khata transfer application requests

h. Khata transfer certificate is issued online

Eligibility

Property should be located in BDA limits. It should be either allotted by BDA or approved by BDA

Documents Required For BDA e-Khata Transfer

Following documents are required to apply for BDA e-Khata Transfer

Sale Deed:

1. Current Sale deed

2. Mother Deed/Previous sale deeds

3. Encumbrance Certificate (Form -15) till date

4. Tax Paid Receipt (Current Year)

5. ID proof

6. Possession Certificate (if available)

7. Allotment Letter (If available)

Death Of Owner:

1. Mother Deed/Previous sale deeds

2. Encumbrance Certificate (Form -15) till date

3. Tax Paid Receipt (Current Year)

4. ID proof (of all family members)

5. Original Death Certificate

6. Family Tree Issued by Competent Authority

7. Self – Affidavit

8. Joint Affidavit

9. Survival Certificate (Only for Govt employee)

10. Indemnity bond

Will (Registered):

1. Will (Registered)

2. Mother Deed/Previous sale deeds

3. Encumbrance Certificate (Form -15) till date

4. Tax Paid Receipt (Current Year)

5. ID proof

6. Original Death Certificate

7. Family Tree Issued by Competent Authority

8. Self Affidavit

9. Joint Affidavit

10. Survival certificate (Only for Govt employee)

11. Indemnity bond

Gift Deed:

1. Gift deed

2. Mother Deed/Previous sale deeds

3. Encumbrance Certificate (Form -15) till date

4. Tax Paid Receipt (Current Year)

5. ID proof

6. Family Tree Issued by Competent Authority

Partition Deed:

1. Partition deed

2. Mother Deed/Previous sale deeds

3. Encumbrance Certificate (Form -15) till date

4. Tax Paid Receipt (Current Year)

5. ID proof

6. Family Tree Issued by Competent Authority

7. Indemnity bond

8. Original death certificate (If original owner is dead)

Release Deed:

1. Release deed

2. Mother Deed/Previous sale deeds

3. Encumbrance Certificate (Form -15) till date

4. Tax Paid Receipt (Current Year)

5. ID proof

Court Decree:

1. Court Order

2. Encumbrance Certificate (Form -15) till date

3. Tax Paid Receipt (Current Year)

4. Sale Deed/Other property related document

5. ID proof

Settlement Deed:

1. Settlement deed

2. Mother Deed/Previous sale deeds

3. Encumbrance Certificate (Form -15) till date

4. Tax Paid Receipt (Current Year)

5. ID proof

Exchange Deed:

1. Exchange deed

2. Mother Deed/Previous sale deeds

3. Encumbrance Certificate (Form -15) till date

Application Fee For BDA e-Khata Transfer

Application Fee : Rs 0

Service Charge (Free for Online Submission) : Rs 35

Delivery Time (Days) : NA