pli.indiapost.gov.in Track Proposal Status : Postal Life Insurance

Organisation : Directorate of Postal Life Insurance

Facility Name : Track Proposal Status

Applicable State/UT : All India

Website : https://pli.indiapost.gov.in/CustomerPortal/Home.action

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Track Postal Life Insurance Proposal Status?

To Track Postal Life Insurance Proposal Status, Follow the below status

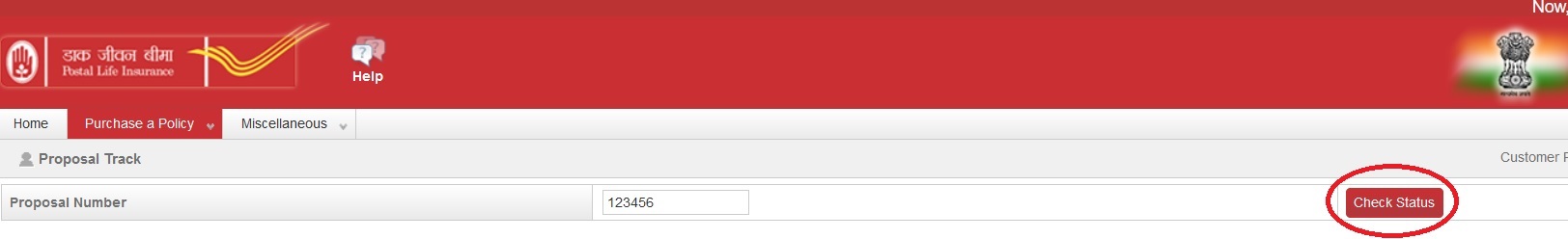

Step-1 : Go to the link https://pli.indiapost.gov.in/CustomerPortal/proposalTrackAction.action

Step-2 : Enter the Proposal Number

Step-3 : Click On “Check Status” button

FAQ On Postal Life Insurance

Frequently Asked Questions FAQ On Postal Life Insurance

When did PLI start?

PLI as a scheme has been available since 01.02.1884.

What is the difference between PLI and other Insurance?

PLI is only for Government, Semi-Government employees and professionals.

Is there any limit to the number of policies one can take for children?

One policy on each child can be taken, subject to the maximum of two children.

How can a policy be transferred from one Post Office to another?

PLI /RPLI policy need not be transferred from one Circle to another Circle. Now premium can be paid at any post office across the country and policy payment can also be taken from any post office.

Which type of PLI policy is more beneficial to opt for without hesitation?

Every scheme has some unique features, as given in pre-pages.

If one spouse is working in a Govt. organization but the other is not, is there any scheme in PLI for both?

‘YugalSuraksha’ scheme under which both can jointly get a policy, after paying a little more premium.

Can one continue the Policy if one quits the Government Service?

One can continue by making payment at any post office throughout the country, even after quitting service.

Is loan facility available?

Loan can be taken from Endowment Assurance, YugalSuraksha after completion of 3 years and in respect of Whole Life, Convertible Whole Life Policy after completion of 4 years. Loan facility is not available in AEA policies.

Is Home loan available?

No

What are the terms on which loan can be availed?

** Endowment Assurance (Santosh)policies after 3 years from date of issue of policy.

** Whole Life Assurance (Suraksha)policies after 4 years.

** Interest @ 10 % p.a calculated on six monthly basis.

** Loan entitlement is calculated on a prefixed proportion of the surrender value.

** Interest is payable once in six months.

What is surrender value of a policy?

“Surrender value” of a policy, means the amount Life assured when on surrender of a policy for immediate cash payment.

What will be the surrender value of the policy?

“Surrender value” of a policy, means the amount Life assured when on surrender of a policy for immediate cash payment.

Can one get the full amount paid with accrued bonus, if policy is surrendered prematurely?

Proportionate Bonus on reduced sum assured is paid if policy is surrendered after 5 years.

What is the mode of premium deposit?

Premium receipt book is issued to the insurants for deposit of Premium in any Departmental PO. There is a facility of recovery from pay for all employees belonging to central government organizations.

Is there any other mode of payment?

Premium can be paid online through https://pli.indiapost.gov.in

Is premium recovered through salary?

Yes, recovery of the premia through salary is possible. If one had taken a PLI policy six years back, but after credit of only 20 monthly premium, the insurant could not deposit further premium and now has realized that due to non credit of premium for 36 months, his policy has become discontinued and no amount against that is payable unless it is revived .

Is it possible to revive this policy?

Yes, before date of last premium, he can apply for its revival and after credit of due premium with interest @ 12% per annum and a good health certificate, he can continue this policy. After revival due bonus will be automatically attached with this policy.

Can one revive a lapsed policy?

If the premia are not paid for 6 month in case policy within 3 year, (or) 12 months in case of policy is for more than 3 years, then the policy becomes lapsed. This needs revival to make it active. Revival shall be on any number of occasions during the entire term of the policy.

What happens if one forgets to pay one’s premium in a month?

One can pay the premium in the subsequent month, by paying a minimum fine of 1% of premium amount per month.

Is income tax rebate admissible for PLI policies?

Available under section 80 C of I.T. Act. toward premium paid.

Is there any special rebate for PLI premium?

For every Rs.20000/- sum assured Rs.1/- is allowed as rebate every month, as long as the policy continues e.g. for taking Rs.one lakh policy PLI allows Rs.5/- as rebate in EA/WLA/AEA policy.

Further, if premium is paid in advance for six months 1 % rebate will be given. If premium is paid in advance for 12 months 2 % rebate will be given. Besides this rebate, Income tax Department also allows rebate on Income tax for your premium payment.

Postal Life Insurance Customer Care

Customers can contact the Customer Care Centre, Office of the Chief PMG of the concerned Postal Circle from where the policy has been taken. Toll free number : 18002666868