IDFC FIRST Bank Loan EMI Payment Using Quick Pay : reporting.idfcfirstbank.com

Organisation : IDFC FIRST Bank

Facility Name : How To Pay Loan EMI Using Quick Pay

Applicable State/UT : All India

Website : https://www.idfcfirstbank.com/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How To Pay IDFC FIRST Bank Loan EMI Using Quick Pay?

To Pay IDFC FIRST Bank Loan EMI Using Quick Pay, Follow the below steps

Steps:

Step-1 : Go to the link https://www.idfcfirstbank.com/

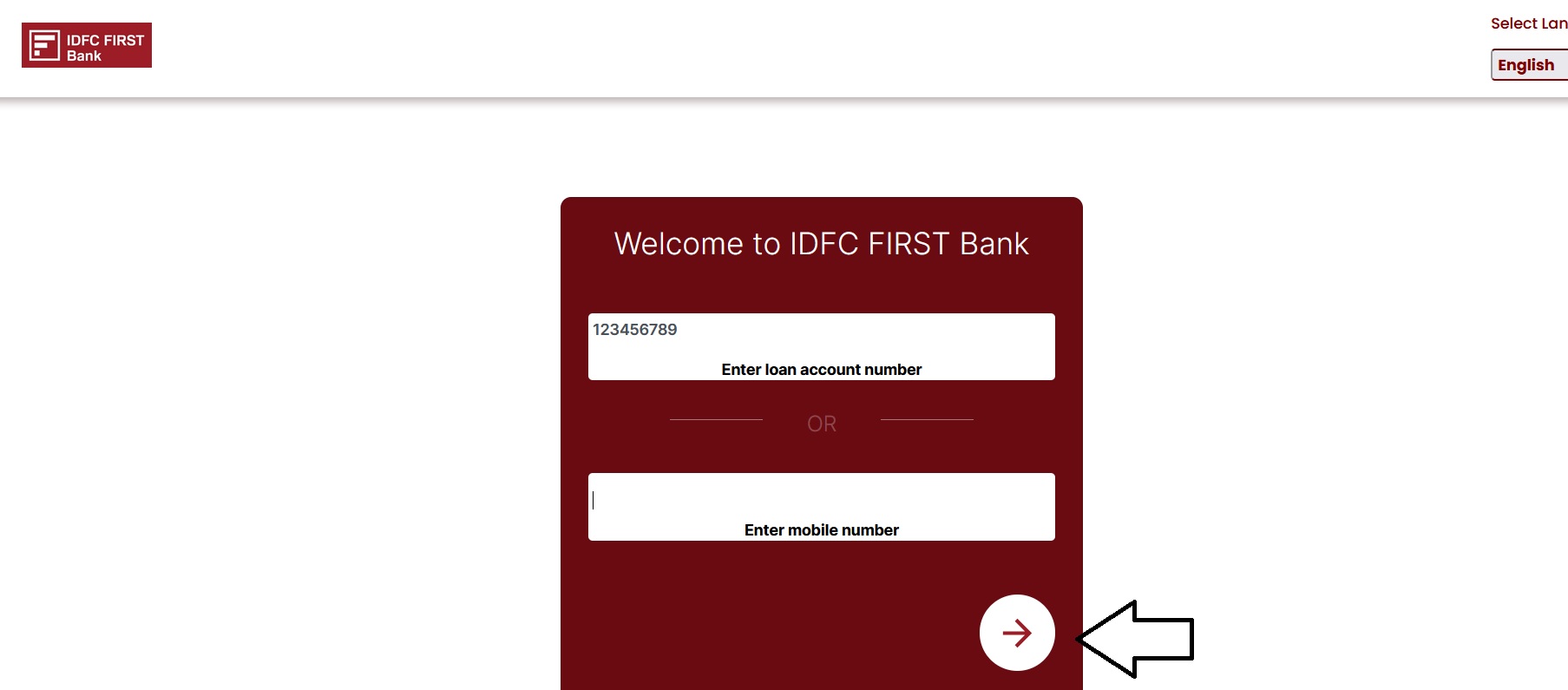

Step-2 : Enter Loan Account Number (or) Mobile Number

Step-3 : Click on the “Arrow”

Note:

No refund/cancellation will be initiated against any of services. Please note payment towards overdue amount and advance up to single EMI will be accepted. Currently this service is not available for customers of IDFC FIRST Bank Home Loan customers

FAQ On IDFC FIRST Bank

Frequently asked questions FAQ On IDFC FIRST Bank

Will there be any change in the servicing of the loan which I had taken from Capital First?

While we are in the process of consolidating the functioning of the two organizations, our customers will continue to get seamless servicing of the loans and can continue to reach out to us at banker@idfcfirstbank.com or call us on our helpline 18605009900.

Shortly, the operations of the two companies will merge and will offer better experience through an integrated mobile app, website, customer contact center and the branch network.

Will Capital First Branches continue to operate?

All our existing branches will continue to operate as is and we are in the process of merging the branch network with that of IDFC Bank Ltd. to be able to provide higher reach to our customers.

If there is any change in the branch locations, we will duly update our customers and also notify the same on our websites, www.capitalfirst.com / www.idfcfirstbank.com

Will there be any change in the customer’s branch?

At present there will be no change in the customer’s branch location, however as we merge our branch network, the reachability will increase and any change or enhancement in the branch will be duly communicated to our customers.

What happens if a customer has loan accounts from both Capital First and IDFC Bank?

At present both the loan facilities will continue as per the terms and conditions at the time of availing the loan. Once we merge the operations of the two organizations, both the loans will be serviced through a single window enhancing the customer experience.

For the loans with Capital First Ltd., the loan facility along with all the underlying security interest(s), if any, and all other rights, benefits and privileges of Company under the Loan Agreement and other related Security and financing documents executed with Capital First Ltd./Capital First Home Finance Ltd. on and from 18th December 2018, stand transferred to vest exclusively in and for the benefit of IDFC Bank Ltd.

Do customers need to register the mobile number or email afresh again with IDFC FIRST Bank for availing SMS/statements etc.?

No, Customers do not need to register their mobile number and email IDs again. The SMS alerts and documents will continue to reach to the customers at the details updated with Capital First.

Will the Capital First mobile application change?

At present, Capital First mobile app will continue to function. Once we merge the operations of the two companies, a more comprehensive app will be available for the customers which will certainly enhance the customer experience.

Customers will also be able to choose from an array of offerings from IDFC FIRST Bank which will be including but not limited to Consumer Durable Loans, Personal Loans, Two Wheeler Loans, Business Loans and Mortgage Loans along with unparalleled Fixed Deposit rates, Savings Account with top-of-the-line debit card, customized Wealth Management solutions and much more.

Contact

Call : 1800 10 888