Amdavad Municipal Corporation : Property Tax Dues & Paid Details

Organisation : Amdavad Municipal Corporation Gujarat

Facility : Property Tax Dues & Paid Details

Home Page :https://ahmedabadcity.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Amdavad Corporation Property Tax Dues

This post describes about various services of property tax dues, its payment receipt, Hall availability etc.

Related / Similar Service :

AMC Citizen Feedback/Suggestion Form

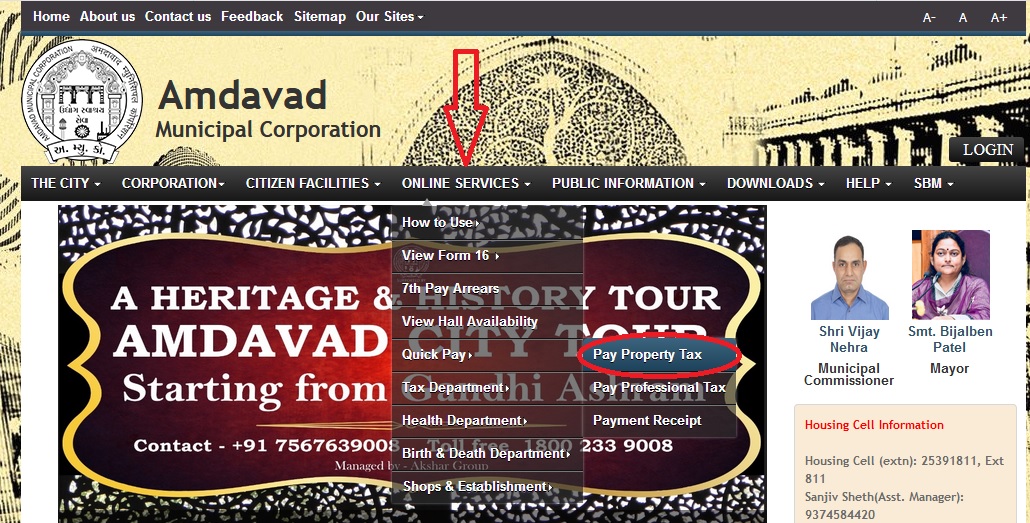

Go to the official website of Amdavad Municipal Corporation. Click the tab Online Services. You will find list of services in the drop down. In that search for Quick Pay, then click Pay Property Tax link.

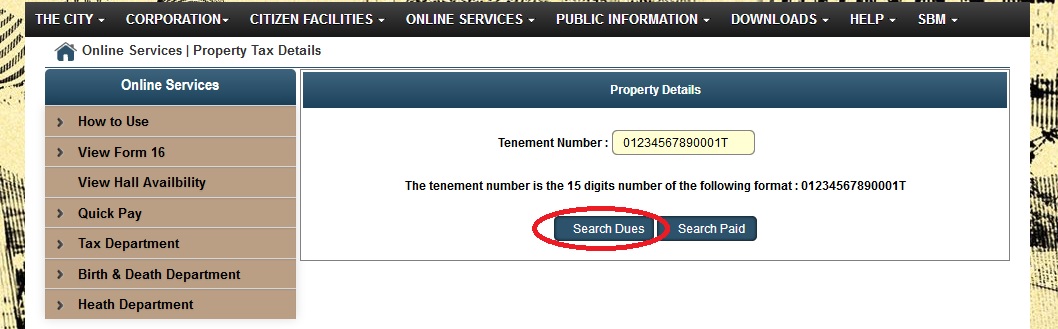

Enter Tenement Number in the text box provided & click search button.

The tenement number is the 15 digits number of the following format – 01234567890001T

Calculation of Property Tax

Property tax is calculated as per the carpet area of the property and 4 factors namely location factor, age factor, type of use factor and occupancy factor as per formula given below

** Gen. Tax=Carpet Area (Sq.mtr) X F1 X F2 X F3 XF4

** where F1= Location factor

** F2=Age factor

** F3=Usage factor

** F4=Occupancy factor

Property tax payable is calculated after addition of water tax, conservancy tax and education cess payable.

Documents should Submit along with application form of 485/1 :

** Sale deed, copy of index

** Copy of city survey in case of gamtal/pole

** Share certificate and society resolution (tharav) in co-operative society

** For Residence proof-election card, rationing card, light bill For non-residential property- Shops & Establishment certificate (Gumastadhara), Sales certificate, Excise certificate etc Other details are mentioned on the backside of 485/1 form.

Procedure for having one bill instead of 2 seperate bills :

or this purpose one should fill form of kami of Duplicate bill. Further details are shown in the form.

Procedure if tenant has vacated the property :

In this case form of Tax Occupier change (TOC) should be filled. Documents for this purpose such as possession receipt of tenant is to be attached.

FAQ On Amdavad Corporation Property Tax

Frequently Asked Questions (FAQs) On Amdavad Corporation Property Tax

Where should I pay my tax?

Property tax can be paid in all city civic centres and tax collection centres. Details all available in our website egovamc.com

In what name should I write my cheque of property tax payment? Is outdated cheque accepted :

Cheque should be in name of ” Municipal Commissioner, Ahmedabad” . Other details such as the ward, Tenament No., contact No. should be written on the backside of the cheque. Out of town cheque is not accepted, However if clearing is done in Ahmedabad it is accepted.

Is there facility of online tax payment :

Yes, tax can be paid online on our website egovamc.com

When do I have to pay Advance tax

Advance tax scheme is generally announced in the month of April every financial year. Advertisement is done in newspapers regarding this.

About Us:

Cities appear and disappear only to reappear in the tableaux of Indian civilization. The historic city of Ahmedabad was founded in the surge of Islamic conquests that had swept through India. It was established in 1411 AD by a noble, Ahmed Shah, who had rebelled against his overlords in Delhi. The new rulers of Gujarat, keen on stablishing their superiority in the material realm, had undertaken a frenzied program of building activities in their new capital of Ahmedabad.

Their model was the impressive Hindu architecture of the previous centuries which they wanted to outshine. The result, after one and a half centuries, was the ‘Sultanate Architecture’ of Ahmedabad, considered a high point of world architectural heritage. This architecture along with the Jain, Swaminarayan and Hindu temples of the city is a veritable safari of monumental architecture which attracts lovers of beauty from across the world to the city

Features of Amdavad Corporation Property Tax

The Amdavad Municipal Corporation (AMC) Property Tax is a tax levied on the annual value of immovable property situated within the jurisdiction of the AMC. The tax is used to fund the civic amenities and services provided by the AMC, such as water supply, sanitation, roads, and parks.

The features of the AMC Property Tax are as follows:

** The tax is levied on the annual value of the property, which is determined by the AMC.

** The tax is payable by the owner of the property.

** The tax is payable in two installments, one in the month of April and the other in the month of November.

** The tax can be paid online, by post, or at the AMC office.

** There are a number of exemptions and concessions available for the payment of property tax.

Where can I pay the tax?

Please give detailed status of outstanding property no 0408-43-0541-0001-T VADODARIA PLASTIC SELF.

HOW SHOULD I REGISTER MY NAME ON MY SHOPEE. NOW ITS ON NAME OF BUILDER OR SOCIETY NAME?

HOW CAN I TRANSFER THE NAME OF SOCIETY ON MY NAME ON MY SHOPEE?