IOB Kisan Credit Card KCC Scheme Loan Apply Online : Indian Overseas Bank

Organisation : IOB Indian Overseas Bank

Facility Name : Kisan Credit Card (KCC) Scheme Loan Apply Online

Applicable State/UT : All India

Website : https://www.iob.in/Apply-Online

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

How to Apply Kisan Credit Card (KCC) Scheme Loan IOB?

To Apply for Kisan Credit Card (KCC) Scheme Loan Follow the steps given below,

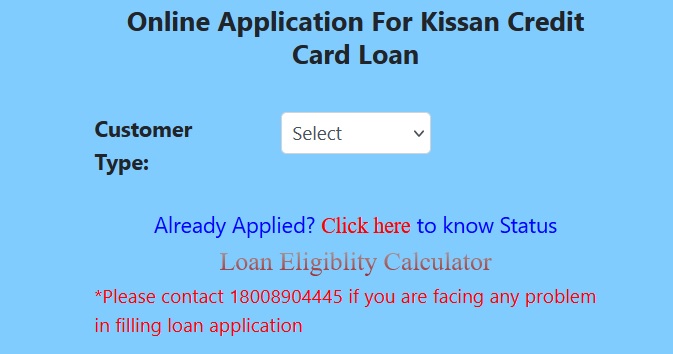

1. Go to the IOB website i.e. https://www.iobnet.org:5444/KCC/

2. Select Customer Type (IOB Customer / New Customer)

3. Enter SB Account Number

4. Enter Captcha Code

5. Click on the “Submit” button.

Kisan Credit Card Scheme aims at providing adequate and timely credit support from the banking system under a single window to the farmers for their cultivation & other needs.

Eligibility :

All Farmers – Individuals / Joint borrowers who are owner cultivators

ii. Tenant Farmers, Oral Lessees & Share Croppers

iii. SHGs or Joint Liability Groups of Farmers including tenant farmers, share croppers etc.

Purpose :

a. To meet the short term credit requirements for cultivation of crops,

b. Post-harvest expenses,

c. Produce marketing loan

d. Consumption requirements of farmer household

e. Working capital for maintenance of farm assets band activities allied to agriculture like dairy animals, inland fishery etc.

f. Investment credit requirement for agriculture and allied activities like pumpsets, sprayers, dairy animals etc.

Amount :

Loan amount / Limit fixed on annual basis depending upon the cropping pattern, Scale of Finance for the crop and the extent of cultivation.

Margin For crop loan component – Nil

For term loan component- 15 % to 25 %

Security New borrowers:

Upto Rs.1.60 Lakh: Hypothecation of crops /assets created out of loan.

Above Rs.1.60 Lakh – Suitable Collateral or TPG at the discretion of the Bank & Hypothecation of crops / assets created out of loan.

Existing borrowers with satisfactory dealing for two years:

Upto Rs. 3 Lakh: Hypothecation of crops /assets created out of loan.

Above Rs. 3 Lakh: Suitable Collateral or TPG at the discretion of the Bank & Hypothecation of crops / assets created out of loan.

Repayment : Limit is valid for 5 years subject to renewal on every year.

Rate of Interest :

For loans below Rs. 3 Lakhs:

The interest rate for short term production credit component upto Rs. 3.00 lakhs for One year form date of sanction/ renewal of the limit is 7% p.a. subject to availability of interest subvention from GOI. Incentive subvention of 3% is also available for the short term production credit upto Rs. 3.00 lakhs, subject to prompt payment within the period of One year form date of Sanction/renewal.

For loans above Rs. 3 Lakhs – Varies from Time to time. Presently one year MCLR+2.50%.

Loan related Documents requirements:

(a) Land /Farm records, Activity particulars

(b) Kisan Card issued by State Govt. (if available)

(c) KYC particulars like Aadhaar card, Voters ID, PAN card etc.

(d) Documents related to Security (wherever security is provided)

FAQ on Kisan Credit Card (KCC) Scheme

Frequently Asked Questions (FAQs) in Kisan Credit Card (KCC) Scheme

Q.1) What is Kisan Credit Card (KCC) Scheme?

Kisan Credit Cards is a loan scheme to farmers for purchase agriculture inputs such as seeds, fertilizers, pesticides etc. and draw cash for their production needs.

Q.2) Can a KCC can be availed in nearest branch of the bank which is not in the service area?

Yes, KCC can be availed with any bank.

Q.3) What are the objective of KCC Scheme?

Scheme aims at providing adequate and timely credit to farmers.

To meet the short term credit requirements for cultivation of crops; Post-harvest expenses; Produce marketing loan; Consumption requirements of farmer household; Working capital for maintenance of farm assets and activities allied to agriculture; Investment credit requirement for agriculture and allied activities.

Q.4) I’m a farmer, but I don’t own any land in my name. Whether I’m eligible for KCC?

Yes. Farmers – individual/joint borrowers who are owner cultivators; Tenant farmers, oral lessees & share croppers; Self Help Groups (SHGs) or Joint Liability Groups (JLGs) of farmers including tenant farmers, share croppers etc. are eligible to avail loan under KCC scheme.

Q.5) What is the tenure of the KCC Card?

The tenure of the KCC card is for 5 years.

Q.6) How will the quantum of finance will be arrived?

The KCC limit will be arrived for 5 years. Scale of finance for the crop (as decided by District Level Technical Committee) x Extent of area cultivated + 10% of limit towards post-harvest/household/ consumption requirements + 20% of limit towards repairs and maintenance expenses of farm assets + crop insurance and/or accident insurance including PAIS, health insurance & asset insurance.

Then every year, 10% of the limit towards cost escalation / increase in scale of finance for every successive year (2nd, 3rd, 4th and 5th year) and estimated term loan component for the tenure of Kisan Credit Card, i.e., five years will be calculated.

Q.7) Whether KCC can be availed for multiple crops?

Yes. In a single KCC accounts, loan for multiple crops can be availed.

Q.8) Can I avail Milch animal loan through KCC?

Yes. Milch animal loan can be availed through KCC.

Q.9) What about fishery loan?

Yes. Loan for fisheries can also be availed through KCC.

Q.10) What will be the tenure of my milch animal loan availed through KCC?

The long term loan limit should be based on the proposed investment(s) during the five year period and the bank’s perception on the repaying capacity of the farmer.

Q.11) What is Interest Subvention?

Short term crop loans upto ₹ 3 lakh are covered under Interest Subvention Scheme/Prompt Repayment Incentive scheme of the Government of India.

Q.12) Can I get Interest Subvention for allied activities and fisheries?

Yes. Loans upto ₹ 2 lakh are covered under Interest Subvention.