bccs.wb.gov.in : West Bengal Bhabishyat Credit Card Scheme (WBBCCS)

Organisation : Department of MSME&T, Government of West Bengal

Facility Name : West Bengal Bhabishyat Credit Card Scheme (WBBCCS)

Applicable For : Young Entreprenuers in the Age Group 18-55 Years

Applicable State/UT : West Bengal

Website : https://bccs.wb.gov.in/

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

What is West Bengal Bhabishyat Credit Card Scheme?

West Bengal Bhabishyat Credit Card Scheme (WBBCCS) is being introduced for the young entreprenuers in the age group 18-55 years by offering subsidy linked and collateral free loans for setting up new ventures/ projects/ micro enterprises in manufacturing, service and buisness/ trading/ agro based activities. Both new unit and existing unit can apply under the scheme for Term loan and/or working capital loan/composite loan.

Related / Similar Facility : Track Clinical Establishment (CE) Application Status Online West Bengal

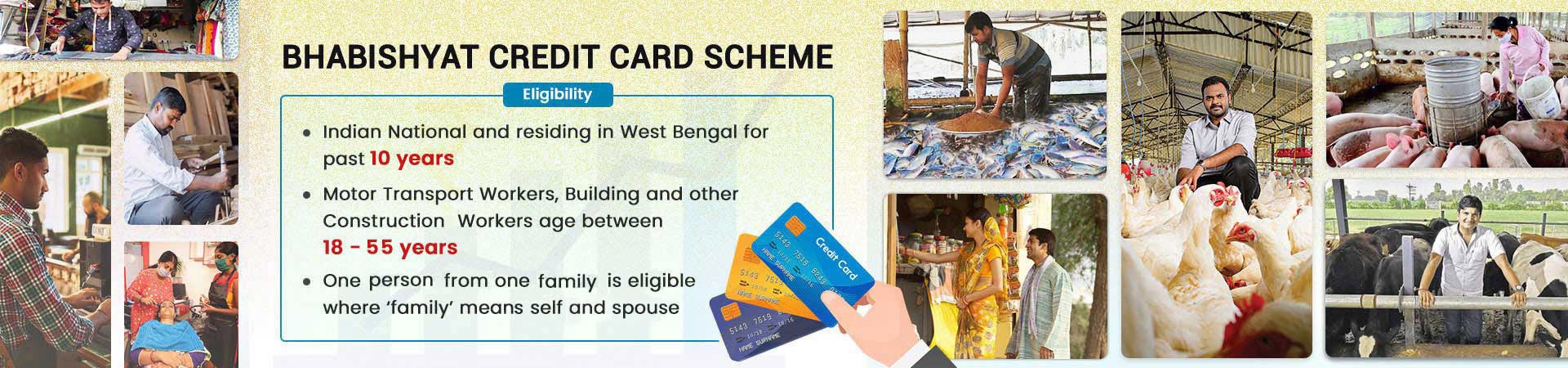

Eligibility of West Bengal Bhabishyat Credit Card Scheme

** Indian national and residing in the state of West Bengal for past 10 years.

** Any eligible individual including Motor Transport workers and Building & other construction workers aged between 18 – 55 years.

** Only one person from one family is eligible under the scheme where the “family” means self and spouse.

Annual Income Family: No Bar

Applicability:

** Any income generating project in manufacturing, service, trading/business, farm sector (Diary, poultry, fish, piggery, etc.) qualifying as an enterprise under the extant definition of MSMED Act 2006.

** Both new unit and existing unit can apply under the scheme for Term loan and/or working capital loan/composite loan. However, a new unit set up under this scheme may be considered for 2nd dose of capital support in machinery/tools or expansion only after two years of implementation.

** All those applications that were sponsored under Karmasathi Prakalpa but not sanctioned as on 1st of April, 2023 will migrate to this scheme.

Non-applicability:

** Employees of Central/ State Government/ Government Undertakings and their families will not be eligible to come under the purview of the Scheme.

** Defaulter borrower in any Bank/Financial Institution.

How To Apply For West Bengal Bhabishyat Credit Card Scheme?

To apply for West Bengal Bhabishyat Credit Card Scheme, Follow the below steps

Steps:

** Click on the “Login” button at the top of the “HOME” page.

** Click on the “Register Here” link.

** A user registration input form will appear, please enter profile detail and click on the “Register” button.

** An OTP is to be sent in your mobile number.

** An input field is to be appear where user will have to input the OTP for activate the user profile. OTP session is 60 sec

FAQ On West Bengal Bhabishyat Credit Card Scheme

Frequently Asked Questions FAQ On West Bengal Bhabishyat Credit Card Scheme

1. Who will register through this online system ?

Any income generating project in manufacturing, service, trading/business, farm sector (Diary, poultry, fish, piggery, etc) qualifying as an enterprise under the extant defination of MSMED Act 2006.

Both new unit and existing unit can apply under the scheme for Term loan and/or working capital loan/composite loan. However, a new unit set up under this scheme may be considered for 2″ dose of capital support in machinery/tools or expansion only after two years of implementation.

2. Is there any age criteria?

Any eligible individual including Mootr Transport workers and Building & other construction workers aged between 18 – 45 years.

3. What is the basic information to provide to get the OTP?

Name, Full Address, Gender, Date of Birth, and mobile number are the basic information to provide to get OTP.

4. How to get the OTP?

Click on the “Login” link a popup page will appear on the screen. Click on the “Register Here” link. Fill up all the required information in the online registration section and after input the mobile number and click on “TAB” button an OTP is to be sent in your mobile number.

5. How to regenerate/resend OTP, if not received for the first time?

To regenerate/resend OTP if not received for the first time click on the ‘Resend’ link after the specified time up, which indicates on the registration screen.

6. How to login into this portal?

Click on the “Login” button, a page will appear on the screen. If Users have already registered in this portal then Enter Username/Email (if entered during user registration), password and CAPTCHA (Image Code) and click on the “Log In” button.

7. What are mandatory information required to fill up during form submission? Or Documents required

The following information are required to fill up during form submission- Applicant Full Name, Father’s / Mother’s / Guardian’s Name, Applicant Date of Birth, Gender, Full Address for communication and project location, Education Qualification, Applicant Category (SC/ST/PHC/OBC/Minority/General), Project Name, Project Cost, Co-operative Bank Name & Address. Supporting Documents Required to upload for application form submission – Proof of Photo identity of the applicant, Proof of Residence, Educational Qualification Certificate, Detailed Project Report, Recent Passport Size Photograph and Applicant Signature.

8. Is there any requirement for the submission of fees for online registration?

No, there is no requirement for the submission of fees for online registration.

9. How to check the status of the Submitted Application?

After successfully logged in, the Applicant can see a link “Details” on the Dashboard. Click on the “Details” link. An applicant can view the application status after successful submission of online application form.