Tejaswini-the Radiant Scheme Jammu and Kashmir : missionyouth.jk.gov.in

Organisation : Government of Jammu and Kashmir (Mission Youth)

Scheme Name : Tejaswini-the Radiant Scheme

Applicable For : Young Entrepreneurs

Applicable State/UT : Jammu and Kashmir

Website : https://missionyouth.jk.gov.in/Schemes

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

What is Tejaswani – The Radiant Scheme?

TEJASWINI is a scheme to promote entrepreneurship among young women. Scheme envisages giving financial assistance upto Rs 5 lakhs to young women for setting up gainful self-employment ventures, suited to their skills, training, aptitude and local conditions. The financial assistance is given to women between the age of 18 to 35 years having a qualification of 10th standard or above.

Related / Similar Scheme : Mission Youth Young Innovators Program Jammu and Kashmir

Benefits of Tejaswani – The Radiant Scheme

** A financial assistance of Rs. 5 lakh under Mudra loan from J&K Bank

** Re-payment of Financial Assistance provided under this scheme shall be interest free.

** Mission Youth, J&K shall provide an amount of Rs. 50,000 or 10% of project cost (Whichever is minimum) as special incentive (subsidy) towards the loan which shall be adjusted towards monthly installments of the loan for first six months.

** Interest subsidy up to Rs 0.60 lakh per beneficiary shall be provided by Mission Youth, J&K.

** The interest subsidy, however, shall be provided only on production of necessary documents (including Bank statement/ Income Tax statement/ certificate by DLIC) testifying the sustainability of the activity.

Eligibility of Tejaswani – The Radiant Scheme

** Any female domicile of J&K, essentially registered with Mission Youth, J&K.

** Any individual women/ women entrepreneur (s)/ enterprise where women entrepreneurs hold not less than 50% of financial holding.

** Preference will be given to the categories of women entrepreneurs trained in Rural Self Employment Training Institutes (R-SETIs)/ Skill Development Institutions etc. any other training institute.

** The applicant should not be a defaulter to any Bank /Financial Institution.

** The financial assistance would be given only to women between the age of 18 to 35 years having a qualification of 10th standard or above. Provided that CEO Mission Youth shall be competent to relax the educational qualification criteria for deserving candidates on a case to case basis, based on proper justification.

** The beneficiary must be unemployed and registered with the concerned District Employment & Counseling Center

** No criteria regarding income of the family would be considered for the eligibility under this scheme.

** One woman can seek the assistance under this scheme only once.

** The amount of self assistance provided by Mission Youth (MY) has to be compulsorily utilized for self employment generation only.

** If the total project cost of the self employment unit to be set up by the beneficiary exceeds Rs 5.00 lakh, the amount over and above shall have to be self financed by the applicant.

How To Apply For Tejaswani – The Radiant Scheme?

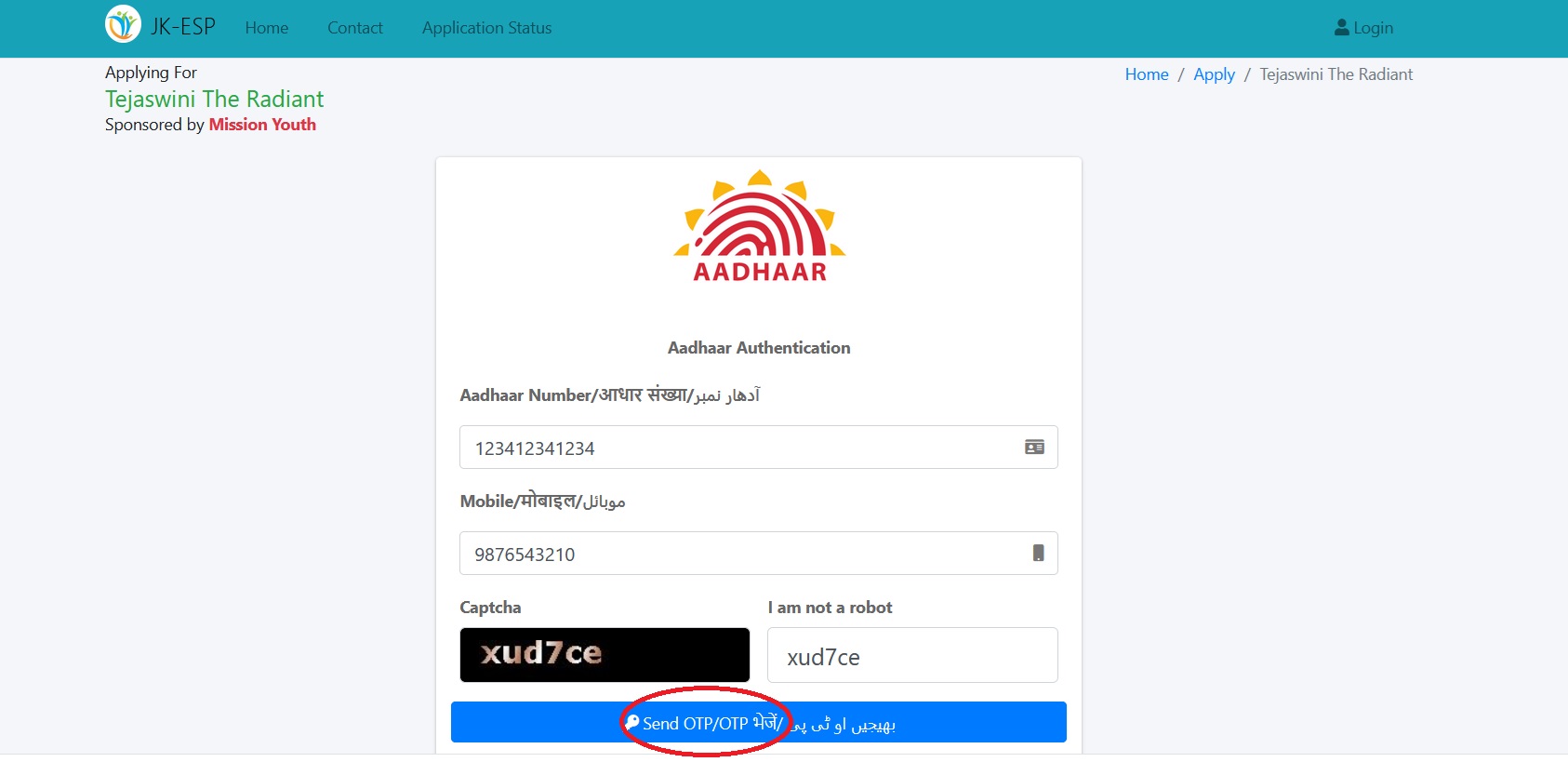

** Visit the URL of Mission Youth Portal

** Select “Scheme”.

** Select “Tejaswani – The Radiant” and click on “Apply Now”.

** An online form opens up. Fill the basic details and upload the required documents as required.

** The applications received at district level shall be placed before the committee.

Apply Here : https://jkgss.jk.gov.in/

Selection Process of Tejaswani – The Radiant Scheme

** The District Level Committee shall finalize the list of eligible applicants after due scrutiny and select the candidates equivalent to the quota allotted to the district (No. of cases to be sanctioned) by Mission Youth for a particular financial year.

** After receipt of consolidated lists of applicants from Districts Mission Youth, J&K shall accord formal sanction to the cases along with release of requisite subsidy.

** The District Lead Bank Officer shall ensure processing and disbursement of loan amount within 15 Days after the approval granted by DLIC.

** The youth selected for financial assistance under the scheme shall furnish an indemnity bond duly attested by a First Class Judicial Magistrate to the following effect:-

** That she is not doing or was not doing any job in Government, Public/Private Sector in Central or any State Government and that she shall not take up any such job without repayment of the loan in full;

** That she has not already availed any financial assistance for self-employment under any Government scheme.

** In the eventuality of default on part of beneficiary towards repayment of loan sanctioned under the scheme, the Bank shall recover the balance amount as per their existing procedure and shall ensure that the contribution of Mission Youth is refunded back to the Mission Youth on proportionate basis.

** In case it is found that the beneficiary has deviated from the indented purpose, Mission Youth, J&K may also initiate legal proceedings against such a person under relevant provisions of law.

** The selected youth shall furnish an indemnity bond duly attested by a First Class Judicial Magistrate to the following effect:-

** That she shall establish the sanctioned unit within the period specified in the DPR submitted by her;

** That she shall incur the sanctioned amount only for the purpose of establishing the said unit;

** That she is not doing or was not doing any job in Government, Public/Private Sector in Central or any State Government and that he shall not take up any such job without repayment of assistance provided under the scheme;

** In case it is found that the assistance given has not been utilized by the beneficiary for the indented purposes, Mission Youth may initiate legal proceedings against such a person under relevant provisions of law.

** That she has not already availed any financial assistance for self employment under any Government scheme.

** At the end of each financial year, the beneficiary will have to submit a copy of GST statement/ bank statement/ / Accounts statement duly certified by a Chartered Accountant for the last quarter as proof of actual operation of the business unit.

** In case, the beneficiary fails to submit such documents, the interest subsidy shall not be released. Besides, Mission Youth may initiate legal proceedings against such a person under relevant provisions of law.