eseva.jharkhandcomtax.gov.in Online Payment & View Payment Status Jharkhand : Department of Commercial Taxes

Organisation : Department of Commercial Taxes

Type of Facility: Online Payment & View Payment Status

State : Jharkhand

| Want to ask a question / comment on this post? Go to bottom of this page. |

|---|

Online Payment: https://ctax.jharkhand.gov.in/web/10231/home

View Payment Status : https://ctax.jharkhand.gov.in/e-payment

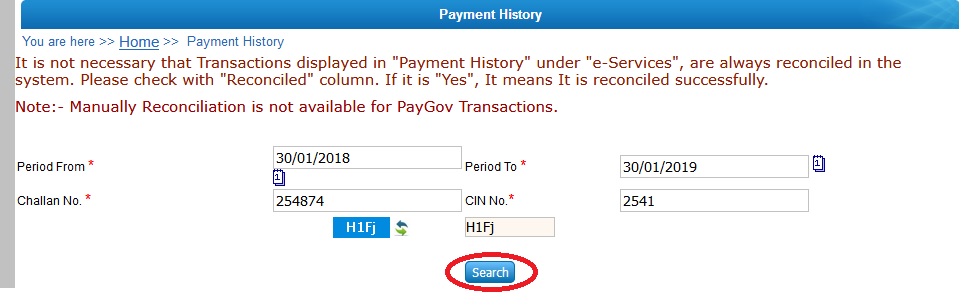

How To View eSeva Payment Status?

Payment is a process for taxpayers to pay their tax liability to Government account (treasury). Payment may be towards their return liability for a particular tax period or might be against demand raised by the department.

Related : Jharkhand Commercial Tax Online Complaint Redressal Service : www.statusin.in/5074.html

Type of Payment:

1. E-Payment via Net Banking

2. E-Payment via Payment Gateway (Now Pay Gov India (All Bank))

3. Offline Payment

Steps For Making A Payment

1. Open Commercial Taxes Department Portal https://esevactax.jharkhand.gov.in/Portal/main.htm?actionCode=showHomePageLnclick

2. On the portal click on “E-Payment” in the “e-Service” panel

3. Choose the type of transaction for e-Payment.

4. Fill up the Challan related details like Payment Type, Tax Type, Tax Period and Payment Head-Wise amount details.

5. Choose the option of Payment – Net Banking or Payment Gateway and select the bank name from list of Banks in case of Net Banking.

6. In case of Net banking, on submitting the details, request goes to the bank’s Portal and all details will be passed to the bank.

7. Taxpayer has to complete the e-Transaction using bank’s credentials.

8. In case of Payment Gateway, on submitting the details request goes to Gateway and all details will be passed to the Payment Gateway.

9. The receipt /e-Challan for this payment are generated electronically upon successful completion of transaction on bank’s portal and status updated in the Department Portal.

10. Bank needs to generate a daily scroll of all payments carried out successfully at its site and upload on RBI/Treasury account as well as on the Department Portal to perform reconciliation process.

How to make payment for the C form Cost:

You need to select the following to make payment for the C form Cost, Select Tax Type as Central Sales Tax, Payment Against as Fees and Purchase as Statutory Forms

What is the new Interest rate and what is the formulae to calculate the interest:

As applicable from 2nd July, 2014, Interest calculation will be 3% for the first three months of delay from the Due date and after that 5% interest rate will be charged. The calculation is (Amount*Tax Rate in percentage*no of days delay from due date)/ 30

About Us:

Department of Commercial Taxes plays a very significant role in the internal resources mobilisation of the State Government of Jharkhand and accounts for almost 80% of the total internal resources. Soon after the creation of the new state of Jharkhand, the Department of Commercial Taxes was constituted in the State as the premier earner of state revenue.

Contact

For Any Queries call to :-

0651 – 6066005 / 2446102 (10:00AM to 6:00PM),

0651- 6999975 / 6999976 (10:00AM to 8:00PM),

7762837076 / 7762837078 (8:00PM to 10:00AM)

If you have any suggestions please send e-mail to suggestions [AT] jharkhandcomtax.gov.in. Please do not send complain or issues to this e-mail. For complain and issues please continue complain log in e-Grievances

Functions of Jharkhand Commercial Taxes

The Department of Commercial Taxes, Jharkhand is responsible for the administration and enforcement of commercial taxes in the state.

The department’s functions include:

** Levy and collection of taxes: The department is responsible for levying and collecting a variety of commercial taxes, including value added tax (VAT), central sales tax (CST), entry tax, electricity duty, hotel luxury tax, entertainment tax, advertisement tax, and professions tax.

** Registration of dealers: The department is responsible for registering dealers who are liable to pay commercial taxes.

** Assessment of tax liability: The department is responsible for assessing the tax liability of dealers.

** Collection of tax: The department is responsible for collecting tax from dealers.

** Enforcement of tax laws: The department is responsible for enforcing tax laws and prosecuting violators.

** Dispute resolution: The department is responsible for resolving disputes between dealers and the department.